During the three years of the Bush administration, more than 3 million jobs in the U.S. have disappeared, been destroyed, dismantled, vanished.

Not since the early years of the Great Depression of the 1930s has America experienced three consecutive years of net job destruction. Nor has any president since Herbert Hoover faced the prospect of leaving office with the economy having fewer jobs than when he entered.

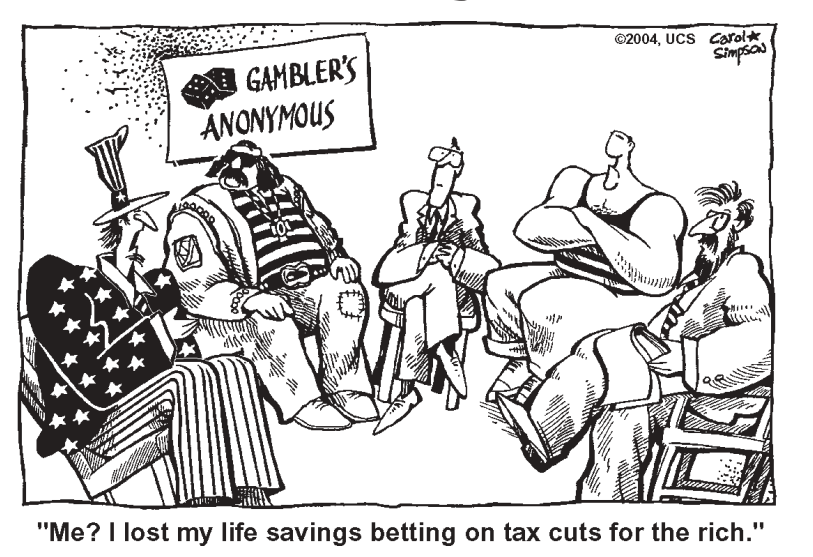

The Bush recession began in March 2001 and was declared officially over in November 2001, six months later. Two major tax cuts, plus a series of additional corporate tax breaks, were enacted between mid-2001 and 2003—tax cuts worth $2.1 trillion—80 percent of which went directly to benefit those with incomes over $147,000 a year.

American workers were promised at the time that these tax cuts were the answer to economic recovery and would create new jobs once again. It was Ronald Reagan’s old “trickle-down economics” argument, brought out of the closet, dusted off once more, prepared for public consumption— but larger than ever before. Even a trickle of that, a worker might argue, could produce significant improvements in jobs or wages. And that’s not counting some share of the tax cut as well. But let’s look at these two—tax cuts and jobs—and how workers fared under George W. Bush the past three years.

To begin with, 84 percent of all taxpayers have incomes below $75,000. That’s the American working class, the largest part of which earn between $40,000 and $50,000, and many more earn less than that. The tax cut in 2003 for the vast majority of workers in the $40-$50,000 range amounted only to $380, and for those in the $50-$75,000 range, only $553.

In both cases that’s less than one percent of their annual income. In fact, with Bush’s tax cuts half of all income tax payers had their taxes cut by less than $100. On the other hand, those with annual incomes of more than $1 million received an average tax cut of $105,636 from Bush. That’s closer to 10 percent of their annual income. So much for the benefits for workers from the tax cut. Let’s look at jobs.

Sleight of hand: the jobless recovery

In early 2001 the President’s Council of Economic Advisors (CEA) announced that if the first round of Bush’s $2.1 trillion tax cuts for the rich were passed quickly, it would result in the creation of 800,000 additional jobs by the end of 2002, all due to the tax cut alone.

And, once again, in February 2003 the President’s CEA assured that the adoption of a second round of Bush tax cuts would create 1.4 million additional jobs—510,000 in 2003 and another 891,000 for 2004—all solely attributable to the tax cuts.

All total, that amounts to a Bush promise of 2.2 million jobs created between 2001 and 2004 as a direct consequence of passage of the $2.1 trillion tax cuts for the rich.

But three large dollops of handouts for the rich have not stemmed the destruction of jobs. Bush’s primary plan for job creation—tax cuts—has proved a dismal failure.

On the other hand, facts have never deterred George W. True to his “stay the course” mentality, even when faced with stark reality of 3 million lost jobs, he today continues to propose further tax cuts for the rich.

After promising in August 2003 to ask for no additional cuts, Bush has once again gone back to the trough in early 2004 and requested in his latest budget yet another big cut for his wealthy friends—this time a $1.8 trillion permanent cut in taxes for the wealthy over the next 10 years.

The long-held consensus among economists is that the U.S. economy needs to add a minimum of 150,000 to 200,000 new jobs each month just to absorb those entering the work force and keep total joblessness from rising.

During the non-recession years of 1993-1999 the average monthly gain in jobs was 250,000. And economists agree that by spring 2004, at this stage of a recovery from the 2001 Bush recession, monthly job creation should be at least at that level. During 2003 the U.S. economy needed to produce 150,000 jobs a month, or 1.8 million jobs for the period, just to stay even. Instead, it actually lost 360,000. That’s in addition to the 1.8 million new workers entering the economy, for a total shortfall of more than 180,000 jobs a month.

The last six months:

the disappearing jobs trick The grand predictions and assurances from Bush and his spokespersons about jobs have been no more accurate in the last six months than they were in 2003 or during the last three years. Since Bush’s trumpeting last October of the 8.2 percent surge in economic growth and promise of massive job creation, jobs have been created at a rate of around only 61,000 a month on average. That’s about 90,000 a month short of the 150,000 minimum jobs needed every month just to absorb new workers entering the labor force. Even the brief surge in jobs that accompanied the 8.2 percent growth rate never came close, in the best months of job creation last October-November, to reaching the 150,000 minimum per month needed for net job creation. And after that brief period last fall, job growth has been down hill once again.

If the government committed just 20 percent ($440 billion) of the $2.1 trillion tax cuts directly to job creation, it would produce a total of nearly 9 million new jobs, each paying $50,000 a year. The 8.2 million unemployed would be eliminated. The wealthy in America with incomes over $147,000 a year have been receiving their 80 percent share of the $2.1 trillion tax cut pie. But the American worker is yet to see the promised jobs.

—continued on page 7