During the 2004 Presidential election campaign, George W. Bush refused to speak truthfully about Social Security privatization. After his alleged victory over Senator John Kerry, he is moving quickly to destroy a Social Security system that has worked remarkably well since 1935.

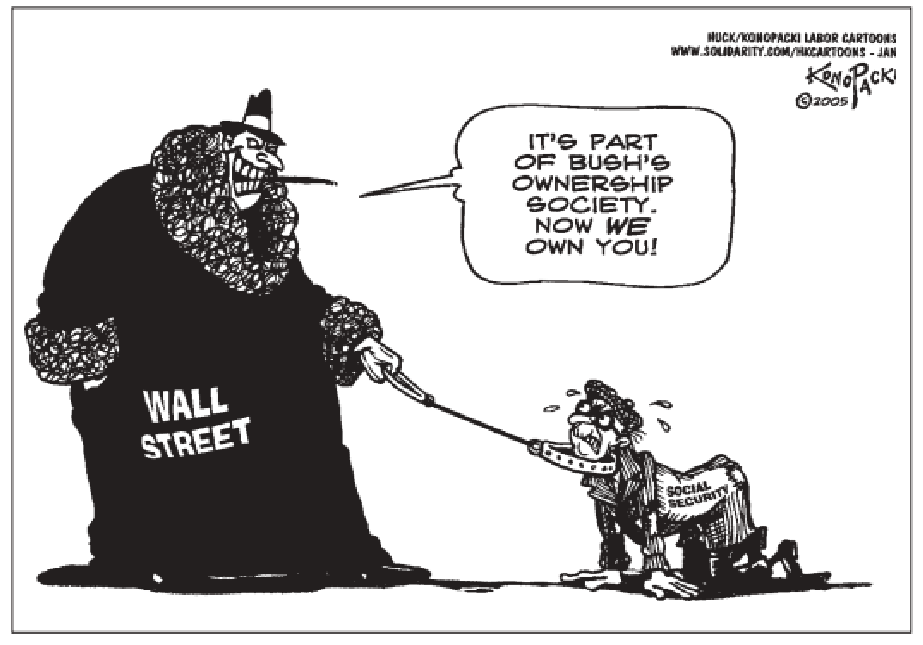

During the campaign, Bush promised that there would be no pain, only gain in forcing younger workers to gamble on the stock market for their retirement needs. He promised that current beneficiaries would not be affected by the scheme. He promised that he wanted “private accounts” for the benefit of workers, not for his friends on Wall Street. He was lying.

Bush has convinced the Republican leaders of the House and Senate that they must move quickly on Social Security privatization in 2005 before the oppostion is mobilized and people realize they are being sold a bill of goods. The administration plans to present a bill to Congress, and in the interim Bush has instructed his aides to tell the American people repeatedly that Social Security is in a state of crisis and that we either need a massive overhaul or we will lose the system. Again, he is lying.

According to the Social Security actuaries, the trust funds currently carry enough reserves to pay full benefits to all who are eligible through 2042. After 2042 the trust funds will still have enough in revenue to pay approximately 75 percent of benefits. What are needed are minor adjustments to the system, not a complete demolition of a traditional system that has worked and provided real security to senior citizens, disabled workers, widows and orphans since 1935.

Prior to the enactment of Social Security, people usually worked as long as their bodies allowed them to. Only the rich or seniors with families to take care of them could retire in dignity. If a worker was too old or disabled to work and did not have family to rely on, they were relegated to the poorhouses. Children of deceased workers were often sent to orphanages.

The Washington Post reported Jan. 4, 2005 that the “Bush Administration will propose changing the formula that sets initial Social Security benefit levels, cutting promised benefits by almost onethird.” Many Social Security beneficiaries on fixed incomes are currently facing difficult choices given the high cost of food, gas and particularly prescription drugs. Now, Bush’s secret plan to take one-third of their Social Security check from them has been unearthed.

Under this leaked proposal, the first year benefits for beneficiaries would be calculated using inflation rates rather than the rise in wages over a worker’s life. Because wages tend to rise considerably faster than inflation, the new formula would stunt the growth of benefits, slowly at first, but more quickly by the middle of the century. The administration is telling younger workers that they will more than make up the difference in the cuts to their Social Security payments by diverting a portion of their Social Security taxes into private accounts. Banking on the stock market is a precarious position for anyone who hopes to have a secure, stable retirement plan.

The rich get richer

Bush’s privatization scheme will cost more than Social Security over the long term. And Wall Street barons and insurance companies want the profits from administering private accounts. Social Security spends one percent of its money on administration. Administrative costs for private investment companies range between 12 and 14 percent, according to the American Council of Life Insurers. Under Chile’s privatized retirement system, investment companies are charging fees of 15 to 20 percent.

Many workers believe they are impervious to making wrong decisions in the stock market and they will always make money. Not true. Since 1956 there have been 10 major downturns in the stock market, during which stock prices have tumbled by 20 percent or more for months and even years. Starting in

—continued on page 7

Social Security works for workers

Social Security is one of the most successful government programs in US history. Since its creation in 1935, it has played a crucial role in making sure that income to a family continues even when a worker retires, dies, or becomes disabled.

To stay strong, Social Security will need to retain the principles that make it successful and to undertake modest, responsible changes. Bush has teamed up with right-wing demagogues and profiteers to foster a sense of crisis in the system for the sole purpose of destroying the traditional system for a private, profit-making enterprise that will assuredly create social instability.

Bush and his allies ignore essential facts, including that Social Security provides disability and survivor benefits for workers and their families; that individual investments produce risks and volatility; and that only Social Security guarantees adequate lifelong income for all working Americans.

Nearly three in 10 workers will become severely disabled, either physically or mentally, and unable to work for some period before retirement. About 7 million disabled American workers and dependents receive benefits from Social Security today. The benefits go not only to disabled wokrers, but to their spouses and children. The benefits give peace of mind to a family struggling with a disability. Social Security benefits will replace up to two-thirds of a worker’s earnings throughout the disability, until retirement age if necessary. If a worker dies, Social Security will pay the survivors slightly more than four-fifths of his or her earnings so that a family devastated by the death of a member will not have to worry about impoverishment too.

Social Security is a lifeline to 30 million retired workers. For most Americans, savings and pensions are not the key to a decent retirement. The key is Social Security. Social Security is particularly important to women. Three out of four women rely on Social Security for half or more of their retirement income. Without Social Security almost half of people 65 and older would live in poverty.

Retirement experts often talk about a three-legged stool: Social Security, pensions and income from savings. Recently, courts have allowed corporations in bankruptcy or reorganization proceedings to withdraw from their pension olbications under collective bargaining agreements. The Pension Benefit Guarantee Corporation (PBGC), the federal agency that is supposed to insure pensions, itself is in financial trouble. Workers have great difficulty in this country saving because wages have stagnated for so long and the cost of health care and other essential needs spirals out of control. Social Security is the most stable of the stool’s legs because it provides the retirement income guaranteed to stay stable even if the stock market drops. Why would we want to create another wobbly leg on a stool? ◆