a voice in running their 401(k) plans. Congress failed to counterbalance Enron-style employer efforts to seduce workers into buying high levels of company stock and took no action to reverse the tide of corporations offering employees unregulated stock option plans rather than real retirement security that can be achieved through a defied pensionbenefit plan. It defeated measures that would have given workers the rights to sue company officials and outside advisors when their misconduct causes losses to workers’ 401(k) accounts and to get information critical to making the best decisions about their retirement investments.

But in the middle of the night Congress passed a personal bankruptcy bill that lines the pockets of credit card companies off the backs of the financially distressed American worker. Congress and Bush conspired to make it virtually impossible for a distressed worker to declare bankruptcy and get a fresh start. The bill will let credit card companies collect from poor people for years after they have sold off their assets in bankruptcy court, and does nothing to stop credit card companies from pushing cards on people already in debt. This bill does nothing to protect workers’ severance in corporate bankruptcies or put workers ahead of inside creditors in bankruptcy proceedings.

At 4:00 a.m. July 27 the U.S. House of Representatives passed Fast Track legislation after a big push from the President. Fast Track will let multinational corporation exploit even more workers and move more jobs to low-wage countries through trade agreements that give unlimited power to multinational corporations.

“This bill actually weakens protections of worker rights and the environment, slights health care protection for workers who lose their jobs and guts provisions designed to protect U.S. domestic trade legislation,” said Robert Borsage, Co-Director of the advocacy group Campaign for America’s Future. The bill, which came out of a Senate/House conference, does nothing to correct the absurd provisions of NAFTA that allow multinational corporations to challenge health and safety legislation in secret trade tribunals. The burgeoning U.S. trade deficit is unsustainable, but instead of fixing the problems in current trade agreements, Congress gave Bush unlimited authority to let multinational corporations run amok over the global economy.

It should be no surprise to anyone that the American people continue to be looted by large corporations. Both the President and the Vice President of the United States come straight out of corporate culture.

According to CorpWatch, an organization formed to hold corporations accountable, then-businessman George W. Bush held a seat on the board of Harken Energy Company from 1987 through 1989. Despite the fact that Harken reported multimillion dollar losses, Bush was granted $180,375 in unsecured loans. These socalled loans were later “forgiven.” Of course, due deference would be given to the son of then-President George Herbert Walker Bush.

No accountability for Insider trading

In January 1990 Harken won a contract to drill for oil in the nation of Bahrain. The contract came at a critical time for the company, since it was flat broke. In fact, Harken owed over $150 million to banks. Harken’s stock then rose dramatically as a result of the contract with Bahrain. In June 1990 Bush unloaded more than 200,000 shares of Harken stock. Bush failed to file the required Securities and Exchange Commission form that provides the SEC with information to determine whether there was any insider trading based on knowledge not yet available to the public. In fact, less than a month before Bush got a memo from Harken CEO Mikel Faulkner that expressed doubts about the company’s liquidity.

Several weeks after Bush made out like a bandit on his stock sales, Harken reported that the company lost $23 million. The SEC closed its investigation of Bush without ever interviewing him or any other Harken director.

Political ties prevent investigation?

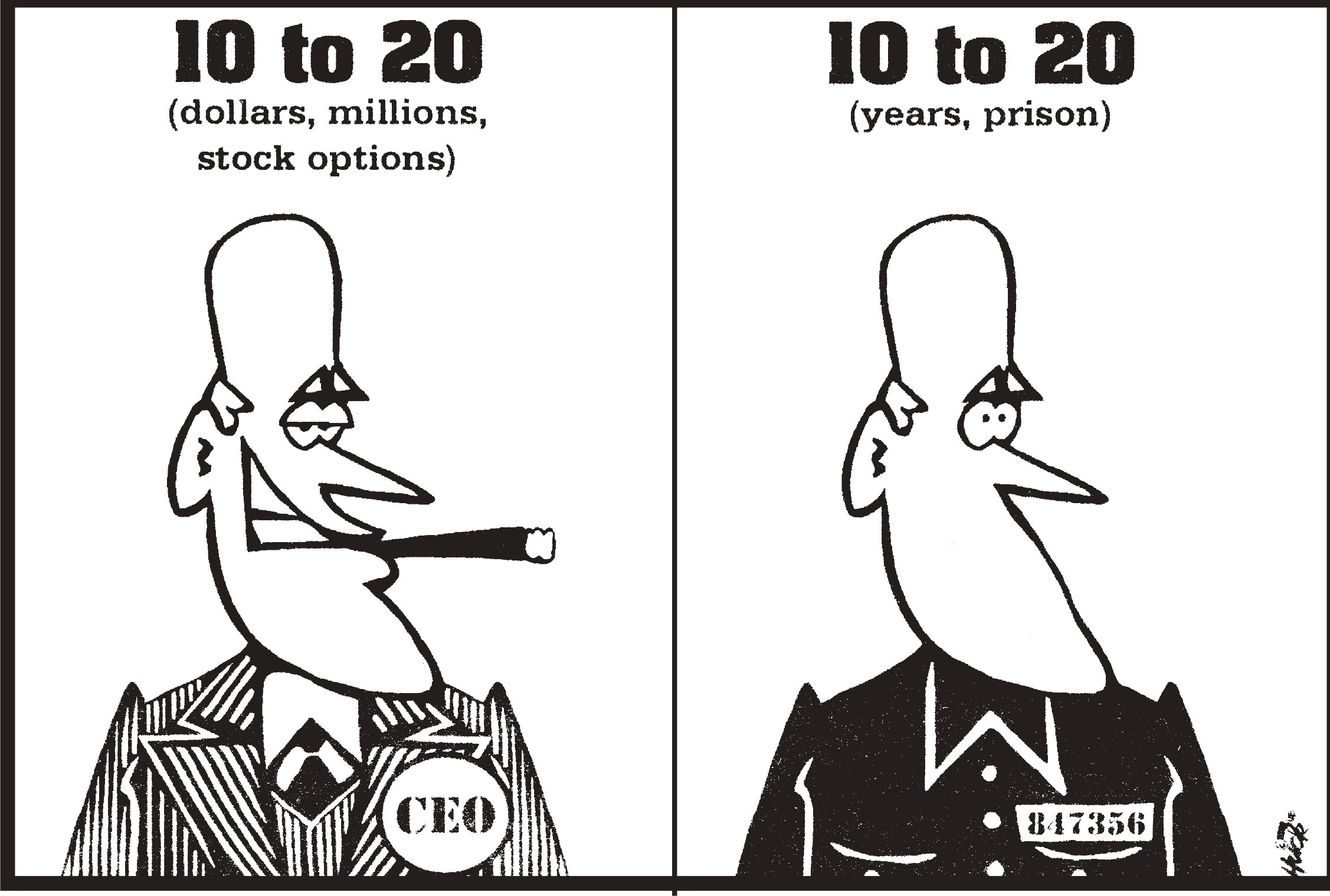

Vice President Dick Cheney was appointed CEO of Halliburton (primarily an oil services company) in 1995 and served until he was sworn in as Vice President. Cheney and his accounting firm, the nowdisgraced Arthur Andersen, decided to cook the books by counting contested revenues (bills customers has refused to pay) starting in 1998. According to the lawsuit filed by Judicial Watch, Cheney and Andersen counted as income disputed costs of up to $113 million for the year ending December 2000.

As we learned from the Enron and WorldCom scandals, cooking the books inflates the price of stock. Cheney had stock options as part of his salary at Halliburton and received nearly $39 million by the time he left. This May the SEC announced it was investigating Halliburton’s aggressive bookkeeping. The company’s stock once soared to $60 a share, but now it sells for less than $14 a share. Current SEC Chairman Harvey Pitt served as Arthur Andersen’s lobbyist before being appointed to the SEC. Pitt will not be likely to roil the waters by sending Cheney to jail for inflating earnings and fleecing investors—many of whom are working-class people who thought they were buying into the American dream and assumed corporations were honest.

Things are bad in Washington, D.C. Working people have to contend with a President who owes the large corporations for putting him in power. The U.S. House of Representatives is controlled by Republican ideologues who always put the interest of working families last. The “Democratic-controlled” Senate, where Democrats have a whopping one-seat majority, is tepid and ineffectual. A sizeable minority of Democrats act more like corporate CEOs than protectors of the American people.

The only way to get this government back to the people is for the people to demand accountability from elected leaders and tell them to put an end to corporate dominance once and for all. You can reach your Member of Congress at (202) 225-3121.

[Hawaii’s congressional delegation has one of the best records when it comes to fighting for working families and against corporate corruption.]