Recently, a beverage worker at an ILWU hotel on the Big Island was denied a bank after the hotel received a bad credit report on that employee. The hotel said it was corporate policy to run credit checks on all employees applying for jobs which required handling money. Workers who fail the credit check don’t get hired or risk losing their current jobs.

New regulations required by the controversial US Patriot Act will require all commercial truck drivers to pass a background check before they will be allowed to transport hazardous materials. Longshore workers will also be subject to similar background checks in order to get an identification card, called a TWIC, to enter the docks. These background checks usually include a review of your credit history.

A bad credit report could cause these workers to lose their jobs. A bad credit report could also prevent you from getting a loan, a life insurance policy, or a job promotion. A bad credit report could make you a security risk in the eyes of the federal government.

Many errors

Do you know what is in your file? Think you have good credit? Always pay your bills on time? This might come as a surprise, but there are serious errors and mistakes in the credit files of over 47 million people and identity thieves could potentially damage the good credit of another 10 million people.

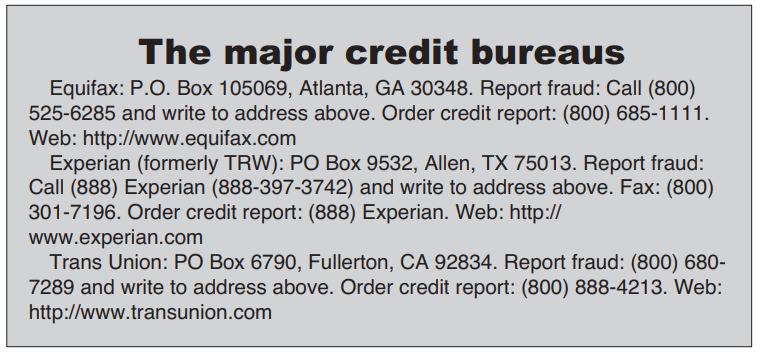

The US credit reporting business is dominated by three companies— Experian, Equifax, and Trans Union. They keep a file on you and approximately 190 million other people. They build these files by collecting and shifting through billions pieces of information every month. This kind of massive data collection is prone to many kinds of errors— typing mistakes when entering data, outdated information, missing information, or mixing up data from people with similar names.

The mistakes can have serious consequences. The consumer group Public Interest Research Group (PIRG) found that 25 percent of the credit reports they studied in 2002 contained serious errors that could affect a person’s credit score. A 2000 study cited by Consumer Reports found more than half had errors. A 1998 survey by PIRG found nearly one in three reports had serious errors.

In addition, some of the damaging credit activity in your report may be the work of identity thieves. The most common crime committed by identity thieves is taking your personal information such as social security number, date of birth, or mother’s maiden name to open a new credit card, checking, or cell phone account. They then use the credit card and charge to the maximum limit, write bad checks, and make phone calls in your name. When they don’t pay the bills, the delinquency goes into your credit report. Most people don’t discover they have been victimized until long after the damage is done.

According to 2002 data collected by the Federal Trade Commission, identity thieves stole over $47.6 billion from financial institutions and $5 billion from their 10 million victims. In Hawaii, identity theft cases in 2003 increased to 649, a nine percent increase over the 593 cases reported in 2002.

Check your report

Your best protection is to regularly check your credit report for accuracy and to detect any unauthorized activity by identity thieves. Hawaii residents will be able to get their credit report for free beginning December 1, 2004, but until then the credit bureaus can charge $9.00 a copy. It’s a good idea to periodically check your report from all three of the credit bureaus.

Inaccurate credit reports were such a serious problem that Congress amended the Fair Credit Reporting Act in 1996 to protect consumers. The law requires the credit bureaus to correct mistakes and provide you with a copy of your report, but it also allows them to charge you $9.00 a copy. You are entitled to a free copy if you have been denied credit, insurance, or a job. You can also get a free copy if you’re unemployed and plan to look for a job within 60 days, are on welfare, or you have reason to believe your report is inaccurate because of fraud or identity theft.

The Fair and Accurate Credit Transactions Act of 2003 gives more protection, but many of its provisions don’t go into effect until December 2004 (such as the free reports).

What to look for

When you get your report, PIRG suggests you should look for the following most common errors:

• Missing or partial information— If you opened accounts with different versions of your name or changed your address, the report may contain only some of your credit information. Some of your accounts many not even appear, particularly those with small, local creditors who may not report to national bureaus.

• Information about someone else is included—Someone else’s information is mixed up with yours, because of a data entry error or your name is similar. You could also be a victim of identity theft.

• Information is reported twice— You may refinance a loan or your mortgage is sold to another lender, and the loans appear twice. This can lower your credit score by making it appear that you are deeply in debt.

• Your on-time payments are reported late—You may have paid on time but your lender is late in recording or reporting your payment.

• Old information is still on your record—Accounts you have closed are still listed as open. Negative information such as late payments, tax judgments, and lawsuits are usually removed after 7 years. Bankruptcy information is removed after 10 years. Criminal convictions stay on your record. There are no time limits if you apply for a job with a salary of more than $75,000 or for more than $150,000 of life insurance.

• False public record information appears—Credit bureaus and their employees often inadequately match public records (tax liens, lawsuits, bankruptcies, court judgments, criminal records, etc.) before adding the information to credit reports. These mistakes are much more damaging to your credit than an occasional late payment.

Correcting mistakes

The Fair Credit Reporting Act requires the credit reporting bureau and the organization that provided the information to the credit bureau to conduct an investigation and correct inaccurate or incomplete information in your report.

You will need to write to the credit bureau and identify the items you believe are inaccurate. Explain why you dispute the information and include copies (keep the originals) of documents that support your position. Send your letter by certified mail, return receipt requested, and keep copies of your letter.

The credit bureau must investigate the items in question—usually within 30 days. They will contact the organization that gave them this information to check the items in question. If the information is inaccurate, the information provider must notify all the other nationwide credit bureaus so they can correct this information in your file. Disputed information that cannot be verified must be deleted from your file.

When the reinvestigation is complete, the credit bureau must give you the written results and a free copy of your report if the dispute results in a change. Also, if you request, the credit bureau must send notices of corrections to anyone who received your report in the past six months. Job applicants can have a corrected copy of their report sent to anyone who received a copy during the past two years for employment purposes.

For more information For a much more detailed explanation of how to dispute and correct your credit report, go to this link at the Federal Trade Commission: http://www.ftc.gov/bcp/conline/ pubs/credit/crdtdis.htm For more information on the ongoing fight to protect consumers, go to the PIRG website at: http://www.pirg.org/consumer/ credit/index.htm ◆