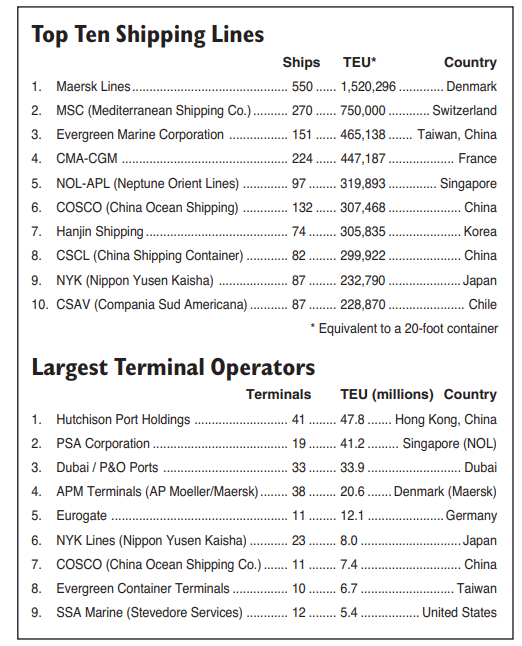

Singapore’s PSA International had offered $6.3 billion, but Dubai Ports World won out with a bid of $7 billion to buy the British Peninsular and Oriental Steam Navigation Company (P&O).

The acquisition caused an uproar in the United States with news that the deal would put Dubai Ports in control of six P&O terminals in major East Coast ports. There was a similar uproar on the West Coast in 1998 when Congress intervened to prevent the Port of Long Beach from leasing land to COSCO for a new terminal. COSCO is Chinese owned and is the world’s sixth largest container shipping company.

The acquisition of P&O makes Dubai Ports the third largest terminal operator in the world, moving up from the number six position. Hutchison Port Holdings, a Chinese company, holds the number one position, followed by PSA International, a Singapore company.

It might surprise Americans that the largest U.S. terminal operator, Stevedore Services of America (SSA), is only number nine on the top ten list. It might also surprise Americans that none of the world’s 20 largest shipping companies are U.S. owned. The two largest U.S. shipping companies, Sea-Land and APL were bought by foreign companies in 1999 and 1997. This means that most of the ships loading and unloading cargo in U.S. ports are owned by foreign companies—mainly European and Asian.

Shipping giants

By far, the largest shipping company in the world is Maersk Lines, a Danish company which operates a fleet of 550 container ships and last year carried about 10 percent of the world’s container cargo or 1.52 million standard 20 foot containers (called TEU). Maersk Lines is part of the AP Moeller/Maersk Group which also owns APM Terminals, the world’s fourth largest container terminal operator. Maersk bought Sea-Land’s international operations and CSX’s container terminals and liner service in 1999.

At a distant number two, with less than half the capacity of Maersk, is the Swiss Mediterranean Shipping Company with 261 ships and a carrying capacity of 720,193 TEU.

At number three is the Taiwanese Evergreen Company with 151 ships and a carrying capacity of 465,138 TEU. Number 4 is the French owned CMA-CGM, with 222 container ships and a capacity of 447,187 TEU. The fifth largest shipping company is Neptune Orient Lines (NOL) owned by the Singapore government. NOL bought APL in 1997.

Supersize shipping

In the last 10 years, a handful of companies have come to dominate the world’s ocean shipping industry. These supersized companies are also transforming the way cargo is moved around the world, using the same methods as the airline industry to maximize loads and minimize costs. Like the airlines, shipping companies are using computers to calculate the best size ships to use on a particular route and the most efficient combination of direct connections and hub-and-spoke networks to move cargo.

They are using super postPanamax ships with up to 10,000 TEU capacity to move containers between “hub” ports designed to handle these massive ships and volume of cargo. Containers are then transferred to smaller ships which serve individual ports.

The two largest container ships in use today are the 9,200 TEU sister ships MSC Pamela and MSC Susanna. They were built by South Korea’s Samsung Heavy Industries for Mediterranean Shipping Company and are 337 m (1,106 ft) long and 46 m (151 ft) wide. They entered service in 2005.

China Ocean Shipping Company (COSCO), has ordered eight 10,000 TEU container ships from South Korea’s Hyundai Heavy Industries at a cost of $100 million a piece. Scheduled for delivery in 2008, each will measure 349 m in length, 45.6 m in width, and 27.2 m in depth. Each will have a 94,000-horsepower diesel for a service speed of 25.8 knots. If anyone is interested, Hyundai says they have completed the design for a 12,000 TEU containership.

Singapore busiest port in 2005

Singapore handled 23.19 million TEUs last year to beat out Hong Kong as the busiest container port in the world. Hong Kong has beaten Singapore every year since 1999, but container volume through Hong Kong increased by only 2 percent to 22.43 million TEU in 2005.

Hong Kong is probably getting less volume because cargo is going to other Chinese ports such as Shenzhen and Shanghai, which handled 400 million tons of cargo in 2005. This included 17 million TEU of containerized cargo, an increase of 20 percent over the year before. Shanghai’s container volume is expected to surpass 20 million TEU in 2006, an increase of 3.4 million TEU. ◆