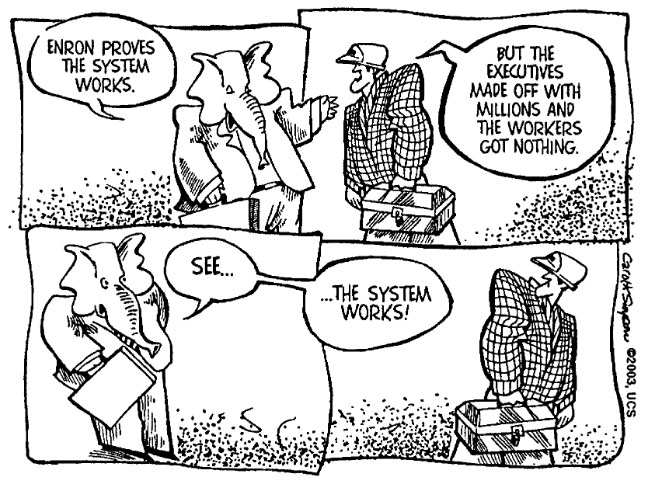

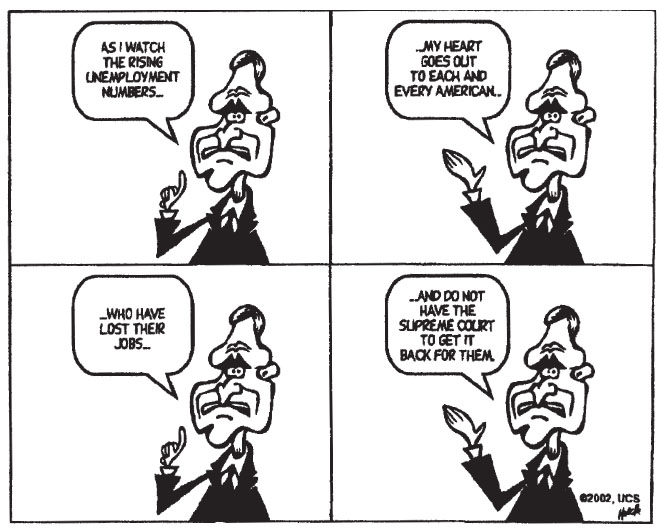

Economic stimulus vs. tax cuts for the rich

Both major political parties “say” something needs to be done to shore up the economy. The details of these plans clearly outline who the parties serve.

Democratic Leader Nancy Pelosi (D-CA) unveiled the Democratic plan, which she said, would “advance a proposal that will be substantial enough to have the immediate effect of stimulating the economy, but at the same time will not cause long-term harm for our budget.”

While considering some sort of “payroll tax holiday” to put money into the hands of hard working Americans, Pelosi blasted the President’s tax cut plan as “Trojan horse” to give more money to the wealthiest Americans. Pelosi stated that the Democrats would not support dipping into the Social Security Trust Fund to pay for such a tax break. According to Pelosi, the

Democratic plan would jump-start the economy by creating more than 1 million new jobs this year, provide relief to laid-off

workers, ease the financial burden on states, and put money into the hands of working families and small business owners. The plan is estimated to cost just $100 billion over 10 years, which Democrats speculate would not bust the budget.

Bush, on the other hand, has proposed a $674 billion dollar package that would be certain to bust the budget. According to

Bush, his plan would accelerate all tax rate cuts and the expansion of the 10% bracket to 2003, exclude stock dividends from

taxable income, accelerate marriage penalty relief and child credit increase to 2003. Finally, the amount of purchases for

equipment small business can write off would be increased to $75,000.

Beyond providing tax cuts for the wealthy, there is little the Bush plan would do to actually stimulate the economy. In fact,

the proposal received a lukewarm reception from the two top Republican tax writers in Congress,who said that the White House “vision” has little chance of passing as it is currently written.

The AFL-CIO has proposed a more expansive stimulus package to create jobs. To meet short-term needs without doing

long-term damage, Congress should pass a recovery plan that:

- Kicks in immediately, rather than years from now;

- Is temporary, rather than permanent;

- Encourages consumption (hence, job creation), rather than saving; and

- Meets commonly-shared needs and serves broad public interests, rather than promoting narrow special interests.

The AFL-CIO calls on Congress to pass and the President to sign an economic recovery package that includes the following components:

- Emergency unemployment benefits;

- Financial help for the states;

- Investments in schools, roads, bridges, water, our industrial base and other infrastructure;

- Tax rebates that will benefit low income and moderate income Americans;

- Minimum wage increase.

Perhaps the most important thing is that the economic recovery package is paid for. Any economic recovery program

carries upfront costs. The cost of proposals to date range from $155 to $300 billion. We can cover those costs—and more—by

modifying the 2001 tax cut, instead of ignoring our nation’s economic crisis with a business-as usual-response.

U.S. House to create Homeland Department monitor

The House is creating a new committee to oversee the Home- land Security Department that is to take shape this year as part of the new rules just passed on Tuesday, January 7, 2003. House Republicans agreed to the new panel as part of a package of

organizing rules that the entire House voted on Tuesday when the 108th Congress opened. There had been some debate over whether congressional oversight of the new department should be handled by existing committees or a new panel.

Also attached to the new rules is a loophole of the gift ban for Member of Congress and staff. The Republican House rules now will allow lobbyists to deliver to House offices catered meals which could include caviar and filet mignon.