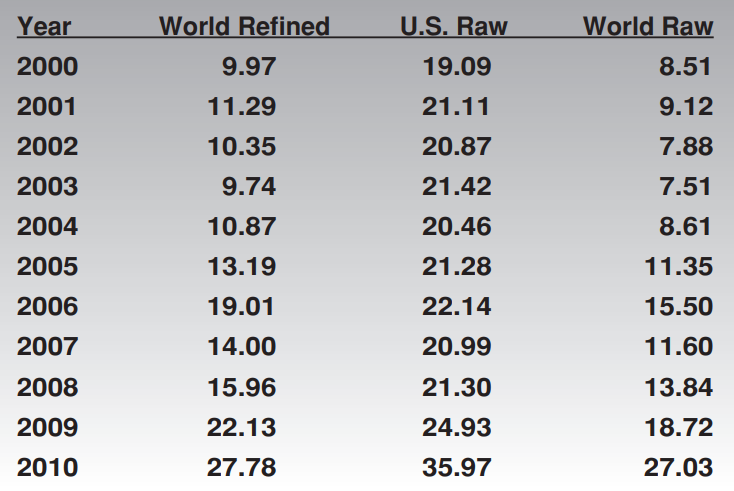

In 2008, world refined sugar prices averaged slightly less than 16 cents a pound. In 2009, prices began a steady climb and ended at nearly 30 cents a pound in December 2009. In 2010, world refined sugar prices dipped to 21 cents but by the end of the year prices hit a thirty-year high of 34.78 cents a pound.

The last time sugar prices were this high was in 1980 when sugar hit 42.3 cents a pound and in 1974 when it hit 57 cents a pound. The high prices have been great news for Maui’s Hawaiian Sugar & Commercial Company (HC&S) which will get top dollar for a harvest of close to 172,000 tons. This is 45,000 tons more sugar than the company produced in 2010, and almost 7 percent higher than the company’s production target of 161,000 tons.

The 2010 financial figures have not yet been published, but by the third quarter of 2010, HC&S reported almost $30 million more in sugar revenues than the same period in 2009. HC&S will make a profit instead of losing over $27 million and ILWU sugar workers will get a 6-month bonus of one percent and a wage increase for exceeding production goals by almost 7 percent

Hard work by a skilled workforce, good weather, and a return to proper cultivation methods helped the company produce more sugar from nearly every field. In contract negotiations ratified on March 12, 2010, HC&S members and the company agreed to a performance based wage increase which will give all union workers a one percent wage increase and a retroactive bonus of one percent of their earnings from August 1, 2010 to January 31, 2011.

The 172,000 tons was more than 169,050 tons, or 5 percent over the target goal of 161,000 tons. Had sugar production hit 177,100 tons, or 10 percent over the target, the wage increase and bonus would have been two percent

The ILWU and HC&S will be negotiating a new collective bargaining agreement which expires January 31, 2011.

HC&S partners with feds to develop commercial biofuel

HC&S partners with feds to develop commercial biofuel Hawaiian Commercial & Sugar Company (HC&S) will receive as much as $4 million a year for the next five years under two federal grants aimed at perfecting the largescale production of ethanol from plants. One of the grants is from the U.S. Department of Energy and the other grant is from the Office of Navy Research.

Most of the ethanol produced in the United States is now made by grinding corn kernels, cooking and fermenting the kernels to produce sugar, and then fermenting the sugar into ethanol. A similar process is used to produce ethanol from sugar cane. Corn-based ethanol produces about 25 percent more energy than it takes to grow the corn.

The United States is the world’s largest producer of corn-based ethanol, making about 40 percent of the world’s supply of 18.9 billion gallons in 2010. However, some 5.1 billion bushels or 40 percent of the US corn crop is used to make this ethanol, which has pushed corn prices higher and in turn raised food prices, as many animals are fed on corn.

The Dept. of Energy is looking at finding a better plant source then corn and a better technology to produce ethanol. The research will be coordinated by the University of Hawaii College of Tropical Agriculture. Test plots on HC&S land are already planted with sweet sorghum, which is a close relative of sugar cane. Sorghum has the advantage of requiring less water, less nitrogen fertilizer then crops such as corn, and produces 20 to 50 tons of stems and leaves per acre. As much as

—continued on page 7

HC&S is planting sweet sorghum to find the ideal source of plant material to make ethanol to mix with gasoline. (L-r) Edison Bacay, Artemeio Bacay, and Teodoro Bonilla flush out drip tubing in test sorghum field. Insert is a closeup of a sorghum plant.

Global conditions lead to record high sugar prices

In September 2008, Kauai’s Gay & Robinson (G&R) Sugar Company announced it would leave the sugar business when the planted crop matures and is harvested. The company stopped planting fields and laid off the planting gangs. As the maturing sugar fields are harvested, more workers would be laid. The final harvest was expected to take place in 2010, but the company decided to harvest all its cane in October 2009 to take advantage of the high sugar prices of 23 cents a pound.

In 2008, US sugar growers were getting 18 cents a pound for raw sugar under the US Department of Agriculture price support program. World raw sugar prices were around 12 cents a pound, but the US kept its sugar prices above 18 cents by limiting imports. At 18 cents a pound, G&R was losing money after paying increased costs for fuel and fertilizer.

In 2009, sugar prices were expected to remain low. After January 1, 2008, the full implementation of the free trade agreement with Mexico eliminated all duty on Mexican sugar. Mexico was expected to sell most of its home grown sugar in the US at the 18 cent price support rate while importing cheaper sugar from the world market for internal consumption in Mexico. This didn’t happen.

Instead, world raw sugar prices began a steady increase throughout 2009 until it hit 24.90 cents in December. Mexico cut back its exports to the US—it was cheaper for Mexico to consume their own sugar instead of selling it to the US.

World prices continued to increase in 2010 and hit 31.09 cents in December. This pushed the average US raw sugar price in 2010 to 36 cents a pound.

Prices will go up

It appears that sugar prices will continue to climb throughout 2011 and 2012, as bad weather reduces the exports of the largest sugar producers and increased wealth leads to more sugar consumed by people in China, India and other developing countries.

—continued on page 7