“Hawaii hotel occupancy down 6.5%”—July 6, 2007, Advertiser.

“Hawaii hotel occupancy rates fell for the 13th straight month in May”—July 7, 2007, Associated Press.

“More visitors seek nonhotel accommodations” —July 6, 2007, Pacific Business News.

Looking at the headlines, you would think the hotel visitor industry was in financial ruins, but reading further in each article there would be some facts that reveal the true story.

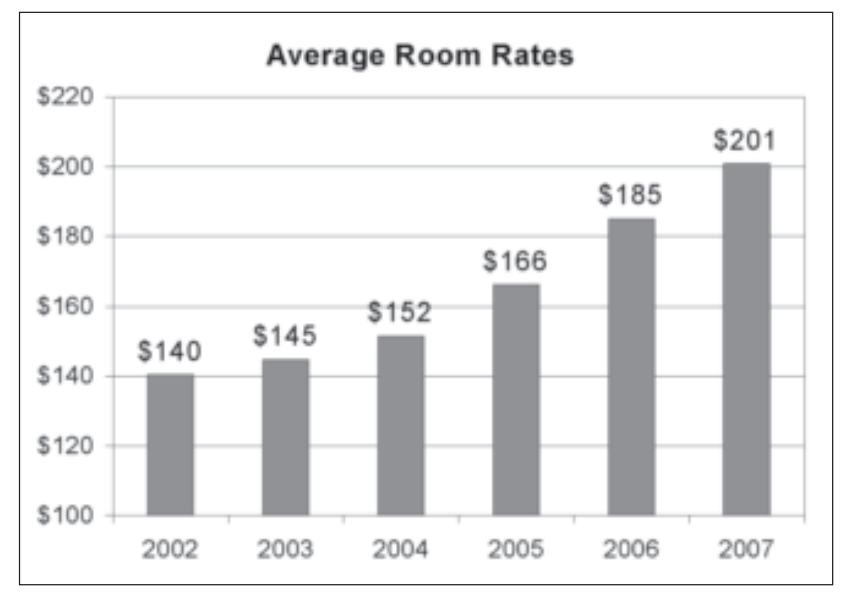

Hotels are charging higher prices for their rooms and profits are good. The average daily room rates charged by Hawaii hotels broke records in 2006.

The Ernst & Young 2007 U.S. Lodging Report noted that in 2006 Hawaii’s average daily room rate of $180 was a new record high, second only to New York at $240 and far ahead of number three Miami at $142. The trend will continue in 2007 and 2008 because of strong demand in the upper-end of the hotel market and only moderate growth in the supply of new hotels.

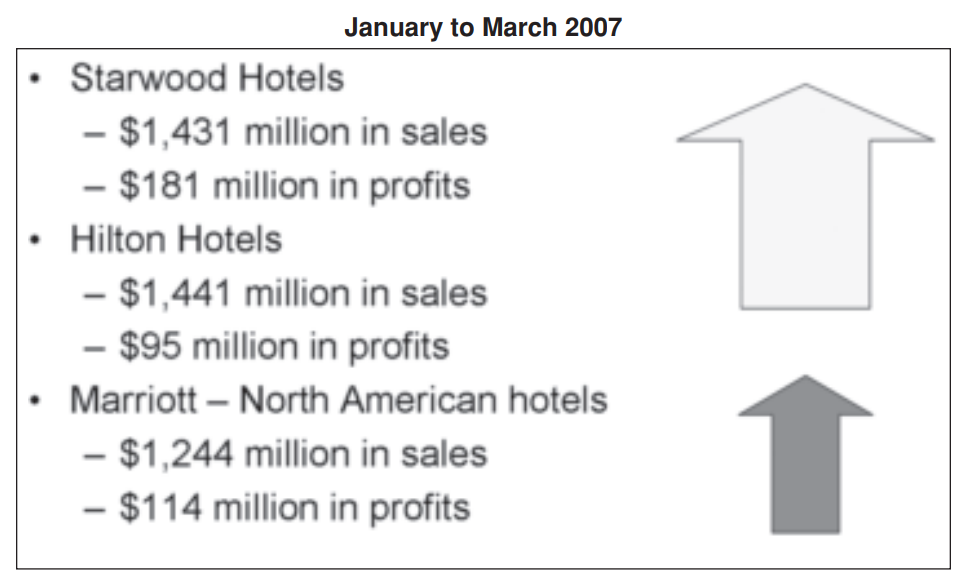

The financial reports of some of the largest hotel corporations in the world tell the same good story. Hilton Hotels Corporation posted first quarter profits of $95 million in their March 31, 2007 10-Q Report filed with the Securities and Exchange Commission. “We anticipate that a favorable economic environment will continue to benefit the lodging industry and us during the remainder of 2007. A continuation of strong hotel demand among business, group and leisure travelers, combined with limited full-service hotel supply growth, should enable us to charge higher room rates.”

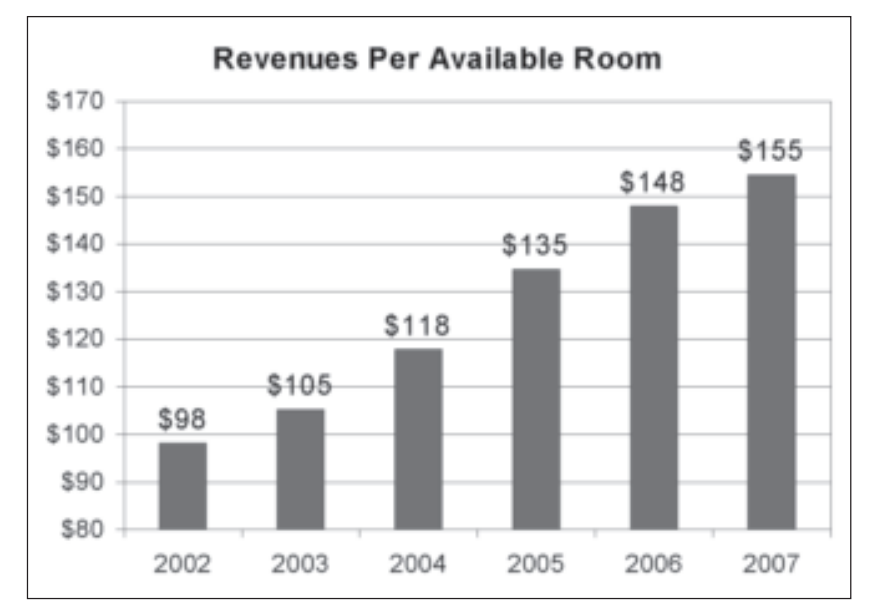

Starwood Hotels and Resorts reported $181 million in profits in their 10-Q Report of March 31, 2007. Starwood reported a 7.6 percent increase in revenues and an increase in revenues per available room (REVPAR) of 8.1 percent for the three months ended March 31, 2007. “REVPAR growth was particularly strong at our owned hotels in Toronto, Canada, Kauai, Hawaii, Philadelphia, Pennsylvania and San Francisco, California.”

Marriott International, Inc. reported $114 million in profits in their 10-Q Report of March 23, 2007. The hotel chain noted continued strength of business travel in 2007, strong demand for luxury full-service hotels, and a limited supply growth of new hotels. “These factors enabled us to increase rates which resulted in solid year-over-year Revenue per Available Room increases. Strong demand also enabled us to reduce discounts and special rates. In addition, group rates continue to increase as business negotiated in earlier years at lower rates is replaced with business negotiated at higher rates.”

The statewide average daily room rate of $185 in 2006 takes the average of the four counties. The average rate on Maui was $241, $189 for Kauai, and $189 for the Big Island. Oahu was the lowest at $156. Oahu is lower because that’s where most of the budget and lower-end hotel rooms are located. Most of the luxury and hotels with ILWU contracts are on the Neighbor Islands.

Hotel occupancy was lower, but the increase in the price of the rooms more than made up for the loss. This is shown in the Revenues Per Available Room chart above. The figure for 2007 is only the first two months of this year.

Visitor arrivals to Hawaii hit an alltime record in 2005 of 7.416 million people. Arrivals dropped slightly in 2006 and 2007 is projected to be a little lower than 2006. Visitors from Japan are down by about 9.4 percent due to a weaker Japanese economy and higher fuel and oil prices. Japanese visitors spend more money and more of them stay in hotels.

Increasing numbers of visitors from the Mainland usually made up for the drop in Japanese visitors, but the increase has slowed to around 2.3 percent in 2007. Economist suspect this is due to high fuel costs and the downturn of the housing market. The economy is expected to improve in the second half of 2007.

Hawaii occupancy is seasonal

Hotels have a slow and busy seasons in the year. The busiest times are July and August with a shorter high point in February. The slowest times are around April and May and November-December.

In 2006, visitors to Hawaii paid over $3.06 billion to hotels and other vacation rentals for their lodging, for which the state received over $221 million in Transient Accommodations Taxes (TAT). In 2005, hotels collected over $2.86 billion in room revenues. In 2004, room revenues was $2.62 billion—a strong year.

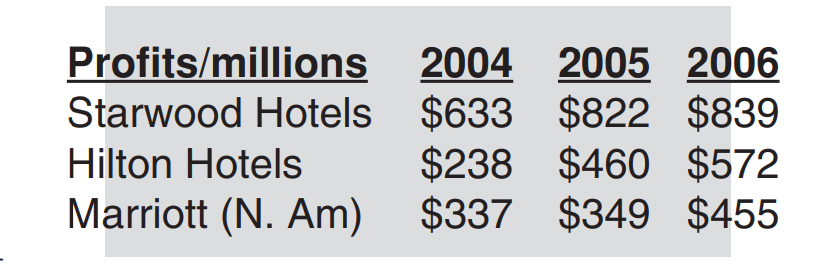

The increase in room revenues in Hawaii and elsewhere are showing up as huge jumps in profits for the big hotel chains. Hilton Hotels posted a corporate-wide operating income of $572 million in 2006. Starwood’s operating income was $839 million and Marriott’s North American lodging business earned the company $455 million.

A limited supply of rooms is another factor that will push prices even higher. Very few new hotels have been built or are under construction. In addition, some of the older hotels are converting rooms to be sold as timeshare or residential units. The combination of more visitors coming to Hawaii and fewer hotel rooms will push room prices and hotel profits even higher for the near future.

Worker shortages

In the same way that a limited supply of rooms leads to higher prices, a worker shortage will push wages and benefits higher.

Hotels are having a hard time finding workers because of Hawaii’s extremely low unemployment rate of 2.36 percent.

This means hotels will need to offer higher wages and benefits to prevent their best workers from finding work in other hotels. ◆