America’s middle class may be suffering from high gas prices and canceling plans to vacation in Hawaii, but the number of millionaires in the world is growing and they will continue their luxury travel and spending even during rough economic times.

The economies of the United States, the European Union, and Japan have slowed, but the Middle East, Latin America, India, and China are booming.

Most of the new millionaires are coming from India, China, Brazil and Russia and they have a big appetite for luxury goods and first class travel.

Merrill Lynch and Capgemini Consulting publishes an annual study of the world’s wealthiest people. These people are called High Net Worth Individuals (HNWI) who have at least $1 million in financial assets which does not include their principle home and personal possessions such as luxury cars and jewelry.

A smaller group of about 103,000 people called the Ultra-High Net Worth Individuals (U-HNWI) have at least $30 million in financial assets. Both groups are growing and accumulating even more wealth.

In 2007, about 600,000 individuals joined the ranks of the High Net Worth Individuals with over $1 million in financial assets. There are now 10.1 million people in this elite group. The total financial assets of this group has grown to $40.7 trillion.

North America has the largest number of High Net Worth Individuals—3.3 million. Europe is second with 3.1 million HNWI, but Asia is catching up with 2.8 million millionaires.

The Merrill Lynch report found that economic turmoil does not change the spending patterns of these wealthy individuals. The wealthy continue to spend their money on exotic cars, jewelry, fine art, collectibles, and first class travel. Rich North Americans lead the world with 17 percent of their spending going to luxury travel. The rest of the world’s wealthy spend between 12-13 percent on luxury travel.

This explains why luxury hotels in Hawaii and elsewhere continue to do well even when the economy is in recession.

Misleading numbers

Recent news stories about the decline in visitor numbers and hotel occupancy are misleading, because the numbers include a large number of mid-scale, moderate, and economy hotels in Waikiki. High fuel costs, higher airfares, and subprime credit troubles have hit the American middle class the hardest. These are the visitors who look for the low airfares and stay at moderate and economy hotels in Waikiki. These hotel segments will suffer the greatest drop in occupancy.

Slow economic growth in Japan and low consumer confidence have led to fewer visitors from Japan.

Good News

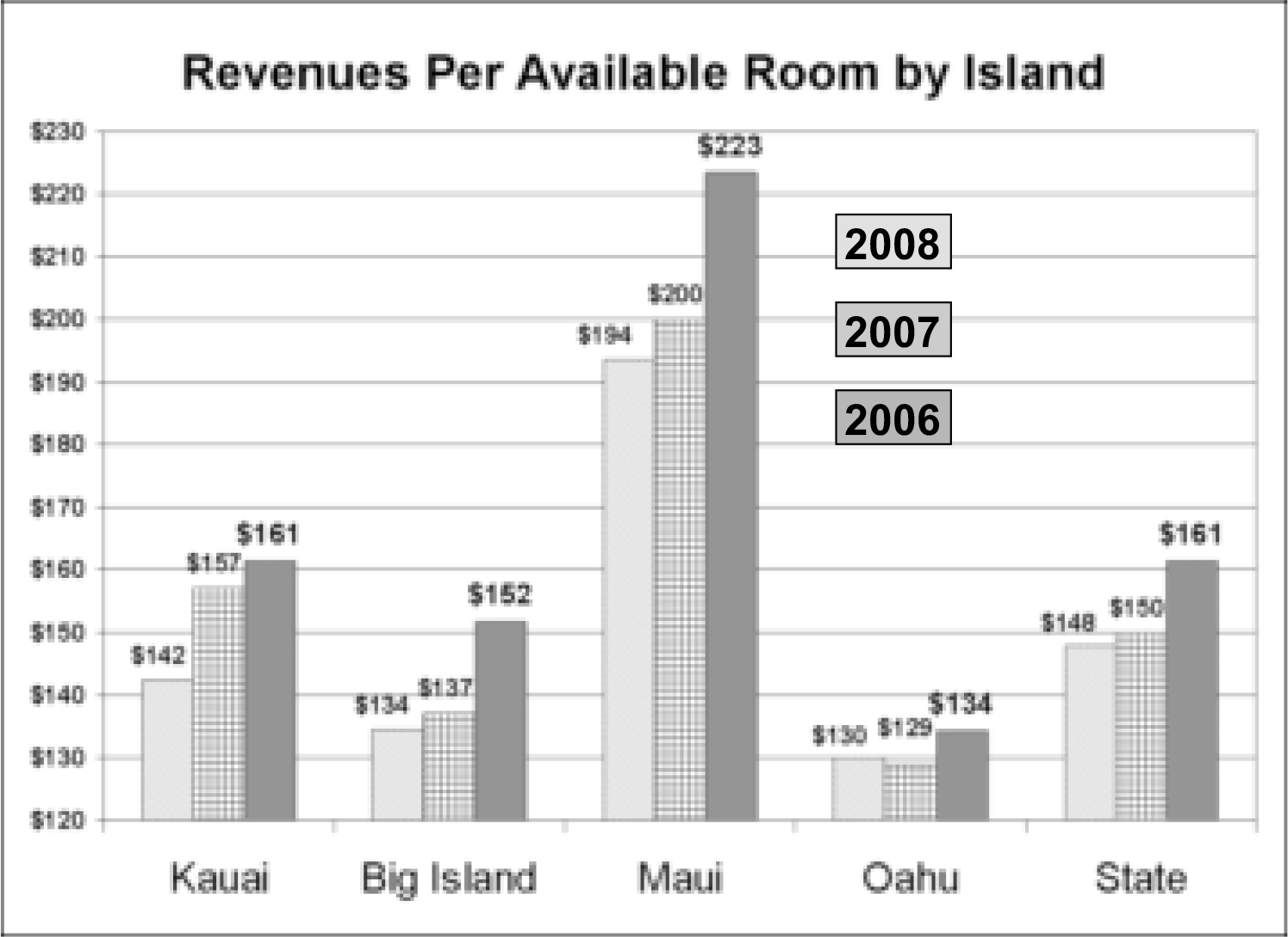

The Neighbor Islands have larger numbers of luxury and upscale hotels and these segments continue to do well even during bad economic times. These hotel segments have been able to increase their room rates which help offset the lower occupancy. The charts below show that Maui and Hawaii had the highest increase in revenues per room in the first quarter of 2008 compared with 2007. Oahu and Kauai had lower increases.

The drop in the dollar’s value compared with other world currencies makes vacations in Hawaii less expensive. This is why more Canadians, Europeans, and Asians are visiting Hawaii. Waiving visas for more countries is expected to greatly increase the number of visitors from South Korea and China.

Overall, international tourism is expected to grow throughout 2008.

What’s happening with Hawaii’s tourism?

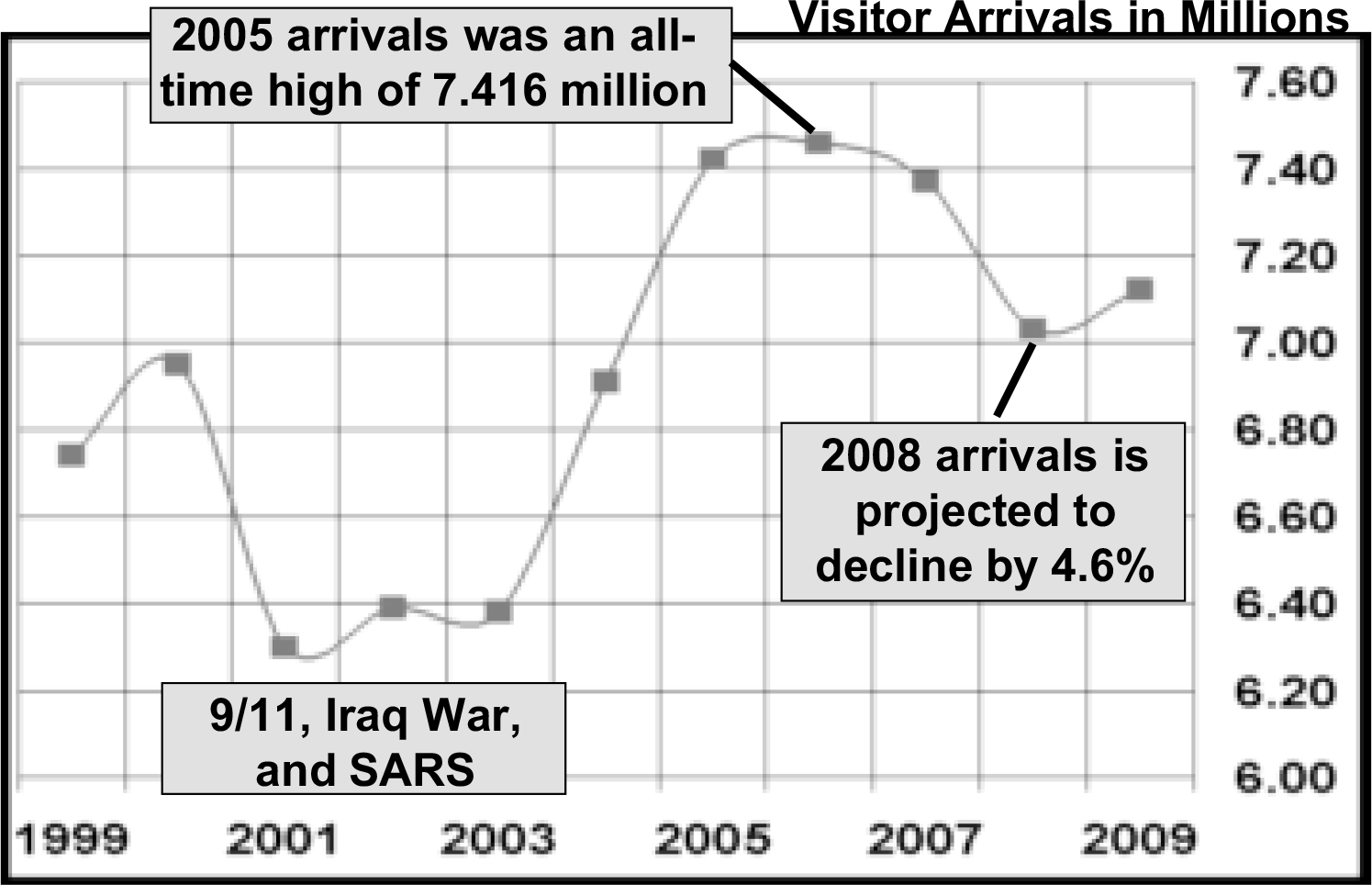

Visitor arrivals to Hawaii is expected to decline by 4.6 percent in 2008 and increase only slightly in 2009, according to the June 13, 2008, forecast issued by the University of Hawaii Economic Research Organization. The decline is due to the failure of Aloha and ATA airlines, high fuel costs and the weaker US economy.

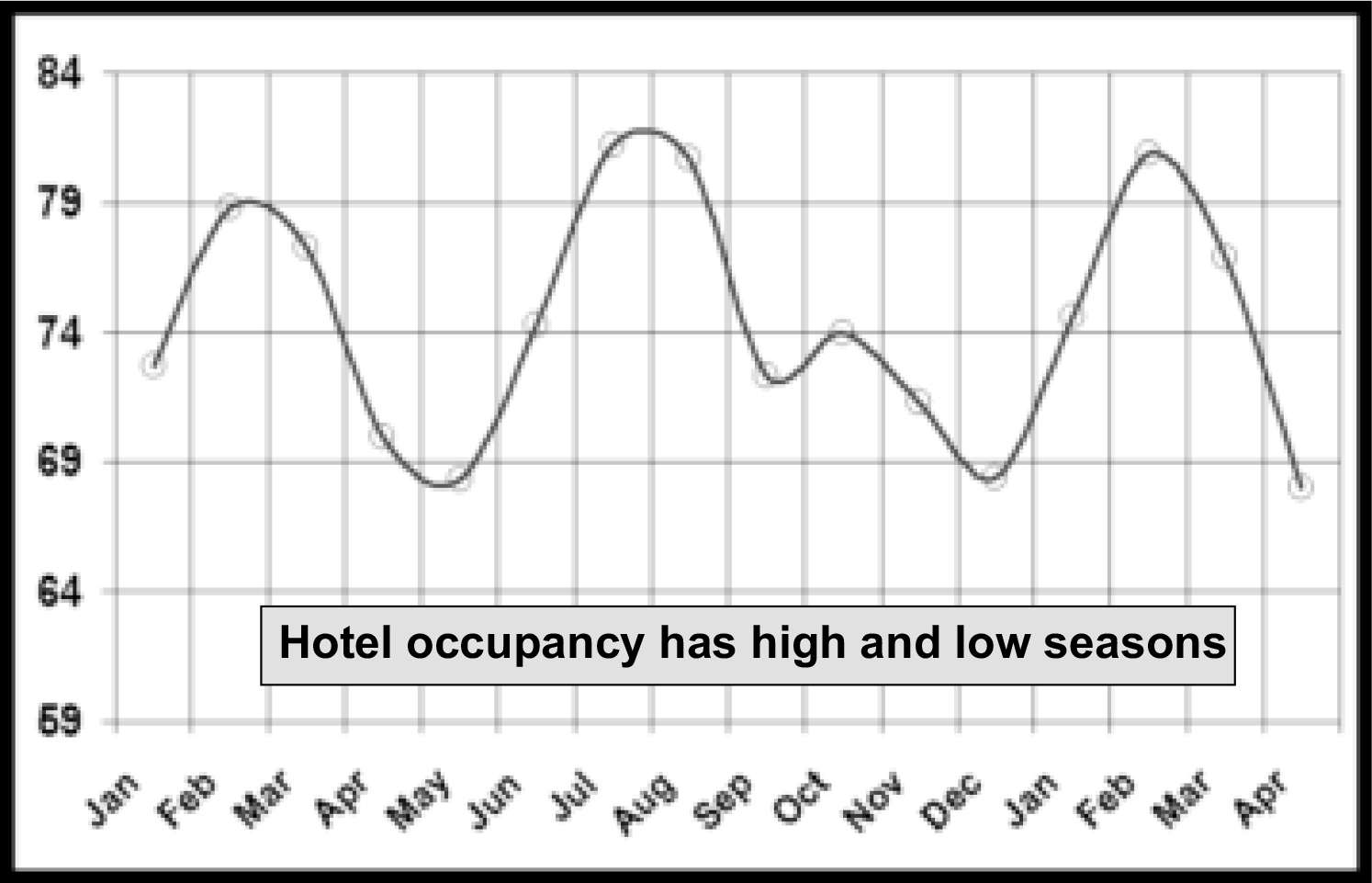

The chart below shows the seasonal nature of the hotel industry. Occupancy is highest in February-March and July-August and lowest in May-June and December-January. This is the state-wide average.

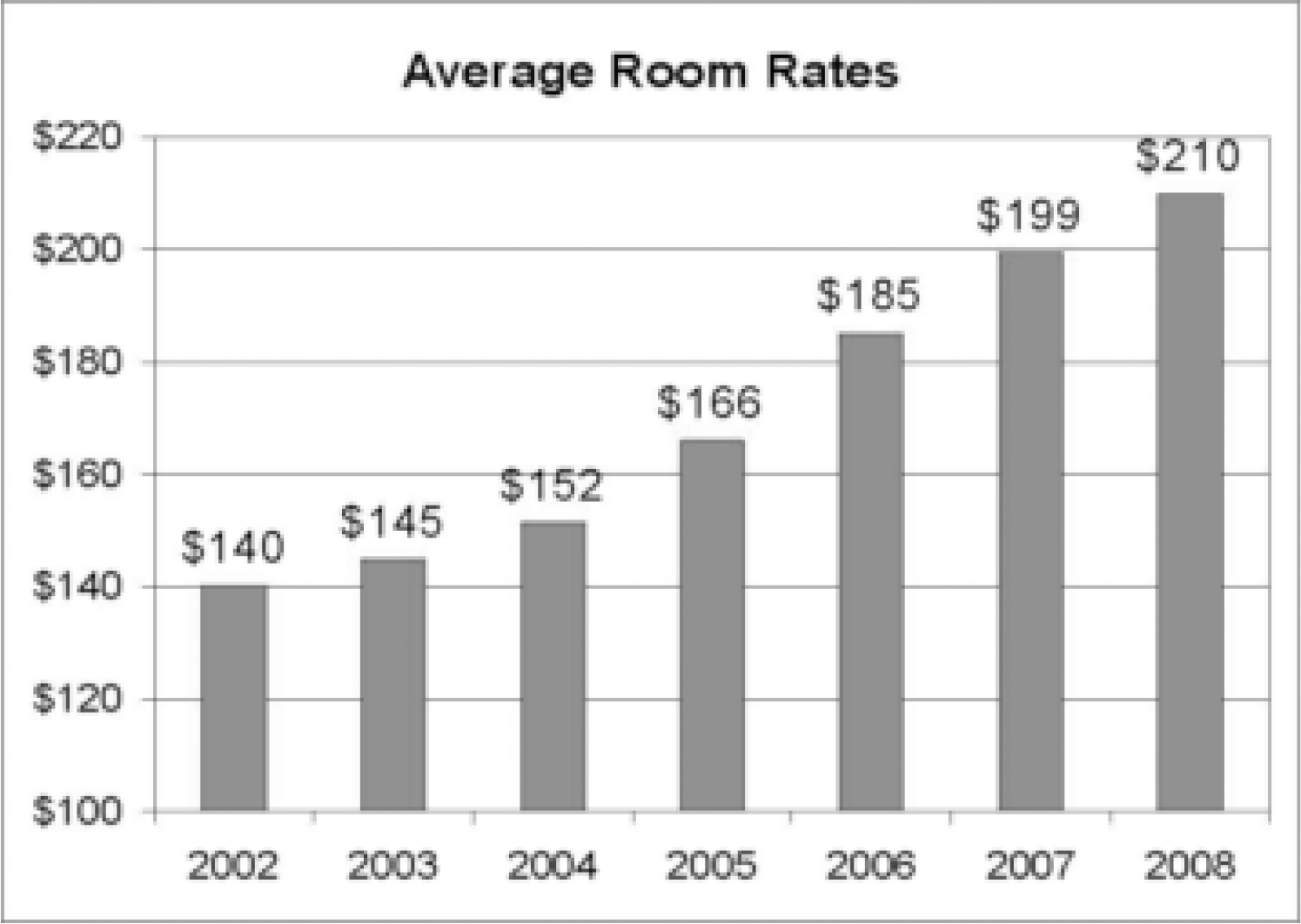

Average room rates have continued to increase, reaching $210 as of April 2008. This is the statewide average.

The chart below shows how Maui and Kauai hotels lead the state in earning the highest revenues per available room. The 2008 figures are for the first quarter from January to March 2008. Luxury and high end hotels continue to do well in a weak economy. Moderate and budget priced hotels are hit the hardest.