National and even regional banks have been cutting back on mortgage, student, and auto loans as they scramble to keep enough cash to cover potential losses caused by the subprime credit crisis.

But credit unions are in good shape, and many of them have plenty of money to loan. Most credit unions follow very conservative, old-fashioned banking practices. They made low risk auto loans and avoided the risky mortgage and commercial construction loans which are causing trouble for so many banks.

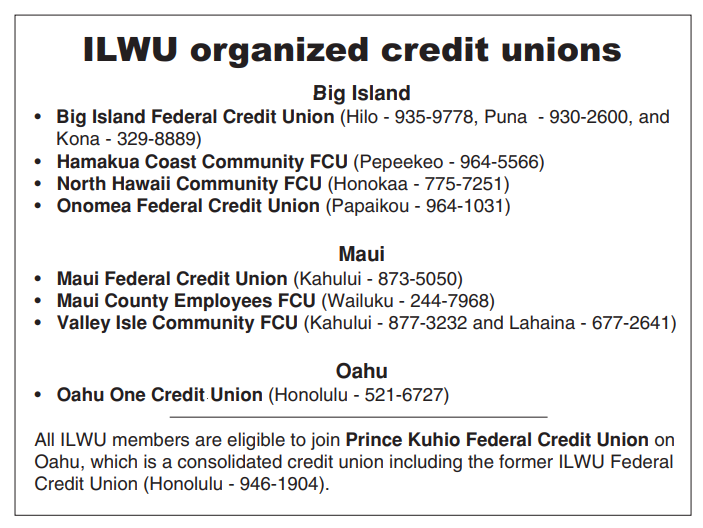

Better yet, the workers of eight credit unions are unionized with the ILWU and have collective bargaining agreements. Most of the unionized credit unions are on the Big Island and Maui and membership may be limited to certain groups, but there are over 100 credit unions in Hawaii which may be open to having you as a member.

You can call the Hawaii Credit Union League at 808-941-0556 or toll-free from the Neighbor Island at 888-331-5646 for the credit union in your area that you are eligible to join. Their website at www.hcul.org also has information on locating a credit union.

Credit Unions are very different from banks. Credit unions are owned by their members who have a loan, a savings or checking account with the credit union. Members come from a defined group, such as government employees, teachers, or employees of a company.

Credit unions are democratically controlled by their members who meet annually and elect a volunteer board of directors (who are also members) who set rules and policies for the credit union. Each member has one vote.

Credit unions operate as non-profit organizations and any earnings are given back to members as higher dividends, lower loan rates, or better services. As not-for-profit organizations, credit unions focus on protecting their members’ money while providing maximum benefit and services.

Credit unions are subject to strict government regulations which require regular financial audits and enough assets to cover loans and potential losses when loans default. Savings up to $100,000 in credit unions are also insured by the federal government through the National Credit Union Share Insurance Fund. (This was increased to $250,000 by the Emergency Economic Stabilization Act of October 2008.)

Banks, on the other hand, are owned and controlled by individuals or groups who own stocks in the bank. Individuals or groups who own more stocks have more votes. The most powerful stockholders elect a paid board of directors who operate the bank to maximize profit for their stockholders. The people with loans or accounts with the bank have no vote or say in how the bank is run.

Onomea FCU is a newly organized ILWU unit that has just negotiated its first contract. (L-r) Denise Rosario, Ruth Miyashiro, Aimee Santos, Edeus Agbalog, Remedios Andrada, and Myrtle Licoan.

Hamakua FCU ILWU members are happy to provide important financial services to the Hamakua community. (L-r) Teller Rhonda Carreira, Unit Treasurer and Teller Michelle Cacabelos, and and Loan Officer Marites Dameg.

Rowena Ireland, Leanne Orevillo and Mel Pagay work in the loan department of the Hilo branch of the Big Island FCU. Big Island FCU also has branches in Puna and Kona for its members’ convenience.

More Oahu bowlers wanted

The Oahu ILWU Mixed Handicap Bowling League starts their 57th year of bowling on January 6, 2009. There are now twenty (20) teams but there is room for twenty-four (24) teams. We are looking for four new teams. The league bowls at Aiea Bowl on Tuesday nights at 6 pm.

Current qualifications and fees are:

1) Each team will consist of five (5) bowlers and must have at least one male and one female; 2) The maximum entering average for new bowlers is 189; and 3) Bowling fee is $16.00 per bowler per night.

If you are interested in entering a team or would like to join a team please contact Howard Toma, Sui Ling Poy or Brian Tanaka at 949-4161.