One out of every three American workers do not have paid sick leave. This is a little over 50 million workers. If these workers get sick and stay home, they receive no pay.

Many will continue to work when they’re sick, and spread their illness to fellow workers and customers.

Every year, the U.S. Department of Labor’s Bureau of Labor Statistics puts out a National Compensation Survey on employee benefits provided by U.S. employers. The March 2008 survey found that only 11 percent of state and local government workers do not have paid sick leave, but that jumped to 39 percent in private industry. This averages out to 35 percent of all American workers who have no paid sick leave.

Most of these workers are parttime—72 percent of part-time workers do not have sick leave, but 25 percent of full-time workers also don’t get paid when they’re sick. The industries with the highest numbers of workers with no sick leave benefits are: construction with 68 percent; hotels and restaurants with 66 percent; and office cleaning and waste services where 63 percent have no sick pay.

Workers who are most likely to have sick leave benefits are managers, professionals, teachers, hospital employees, and unionized workers.

No national law

The United States is one of only a handful of countries that does not have a national law that requires paid sick leave. Instead, the United States leaves it up to private business to voluntarily provide sick leave, for unions to negotiate this benefit into their collective bargaining agreements, or for states and cities to pass laws at the local level.

The U.S. did pass the Family Medical Leave Act in 1993, but this only provides the right to take unpaid leave for certain family events or medical conditions that qualify as “serious health conditions.”

Only a handful of states (California, Hawaii, New Jersey, New York, and Rhode Island) and the Commonwealth of Puerto Rico require some kind of sick leave benefit or temporary disability benefit by law. More recently, the cities of San Francisco, Washington, D.C., and Milwaukee have passed mandatory sick leave laws. In 2008, a number of states came close to enacting mandatory sick leave laws.

The 2007 “Work, Family, and Equity Index” produced by the Institute for Health and Social Policy of McGill University of Montreal, Canada compared work and family policies of 177 countries. The United States lagged far behind the world in laws that protect working families— 169 countries have guaranteed leave with pay for women in connection with childbirth; 145 countries require paid sick days for illness; 137 countries mandate paid annual leave; 134 countries fix a maximum length of the work week; 126 countries provide a mandatory day of rest each week; and 107 countries protect working women’s right to breastfeed their infants.

To see the full study visit: http://www.mcgill.ca/files/ ihsp/WFEI2007.pdf

Many countries have far better leave benefits than U.S.

Workers in most of the advanced, industrial countries have benefits that far exceed those of the United States.

These countries have national social insurance that is funded by taxes on employees and employers like our Social Security. However, unlike our limited Social Security benefits, the national social insurance programs of other countries provide a much wider range of benefits which often includes sick leave, family leave, health care, pension, and unemployment pay.

We’ll use Norway as an example, since their employment laws are available in English. Other Western European countries have very similar benefits.

Norwegian worker benefits

Sick leave is paid by employer from day 1 to day 16. Then by National Insurance Scheme for up to 260 days.

Care for sick child up to 12 years old - 10 days per year for one child, 15 days for two or more children per eligible spouse. 10 additional days for chronic illness or disabled child up to 18 years of age. Employer pays first 10 days. National Insurance pays for the remaining days.

Maternity benefits is 100% pay up to 44 weeks or 80% pay up to 54 weeks. Mother must take 4 week prior to birth and 6 weeks after birth. Father gets 6 weeks. Remaining 28 weeks is shared between parents. Can be used up to age 3 of the child.

Unemployment pay is based on income but comes to about 62.4% of pay. Unemployment is paid for at least 52 weeks and up to 2 years if you earned more than $19,650 in the previous year.

Child allowance of $5,800 a year for child under 3 with no subsidized day care. In addition, Norway’s Annual Holiday Act requires employers to provide 21 holidays a year. Most employees, through their union contracts, get 25 days a year. Persons over age 60 get an additional one week of holidays.

Low taxes leads to inferior social benefits

U.S. workers and U.S. corporations pay among the lowest taxes compared to the richer, developed countries. As a result, U.S. workers have some of the worst sick leave, family leave, and maternity benefits.

When workers in the U.S. lose their jobs, they lose their medical coverage. This doesn’t happen in other countries where national insurance pays for medical benefits.

In many countries workers and employers pay higher taxes but this pays for health care, sick leave, vacations, retirement, family leave, unemployment benefits, and much more. See stories above.

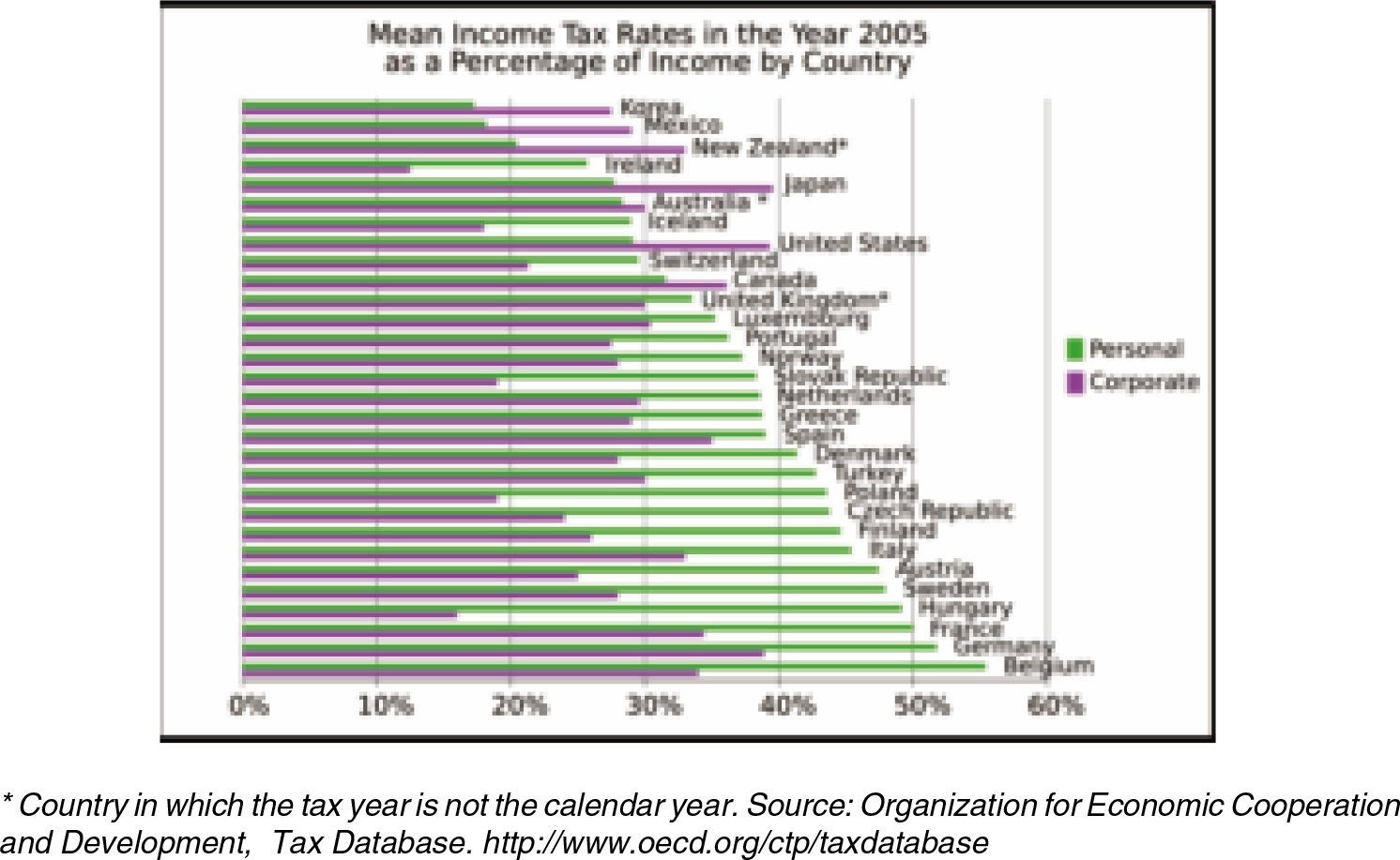

U.S. personal taxes averaged 11.8 percent of their income in 2007 and are lower than 17 other countries and much lower than the 16.2 percent average of the 30 member countries of the Organization for Economic Cooperation and Development (OECD). OECD countries have market economies and representative democracies similar to the United States.

The 11.8 percent is for a married couple with one wage-earner and two children. It includes federal, local, and social security taxes. It also counts tax rebates and cash benefits received by the family of four.

The highest personal tax is in Turkey and Denmark, where the same couple above would pay about 30 percent of their income in taxes.

The tax rate increases considerably for a single person with no children. It averaged 24.5 percent in the U.S., which is a little lower than the 26.6 percent average of the 30 OECD member countries. The highest tax average was 43 percent in Germany and 42 percent in Belgium for a single person with no children.

US social security taxes low

All but one OECD country requires employers to pay social security or national insurance taxes on behalf of each employee.

The U.S. pays 7.8 percent of payroll towards social security, which is among the lowest of the OECD countries. The average employer payment for social security taxes is 18.7 percent of payroll.

Twenty-five countries pay more than the U.S. French employers pay the most at 42 percent of payroll, followed by the Czech Republic at 35 percent and Hungary at 34.6 percent.

ent. U.S. workers paid an average of 7.7 percent of their wages for social security, which is much lower than the average of 10.7 percent for all OECD countries.

Workers in Germany, the Netherlands, and Poland paid the highest social security taxes, with Polish workers paying the most at 24.7 percent of their wages.

US corporations pay less

The U.S. corporate tax rate of 39 percent is the second highest next to Japan. However, U.S. corporations actually paid below average taxes of about 25-27 percent by using tax breaks and other strategies to shelter their profits and avoid the 39 percent tax rate.

The U.S. Treasury Department revealed how U.S. companies avoided high taxes in a July 2007 paper on Business Taxation and Global Competitiveness.

The Treasury Department found that larger corporations shifted their income to overseas affiliates in low tax countries and both large and small corporations passed income to their owners where it would be taxed at the lower 28 percent personal tax.

Between 2000 and 2005, U.S. corporate taxes was 2.2 percent of the Gross Domestic Product (the sum of all economic activity in the country). The average for the 30 mostly rich member countries of the Organization for Economic Cooperation and Development was 3.4 percent.