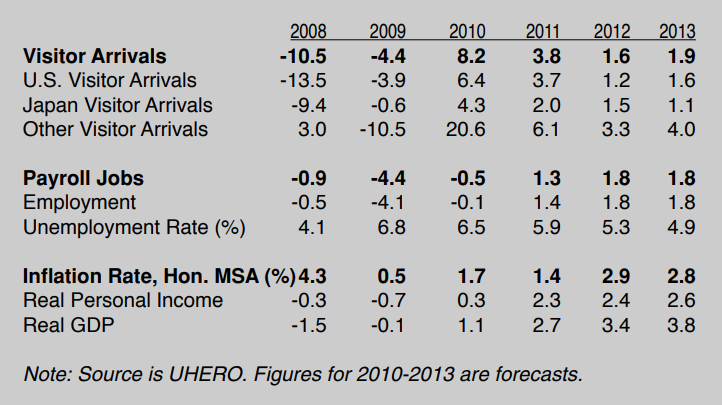

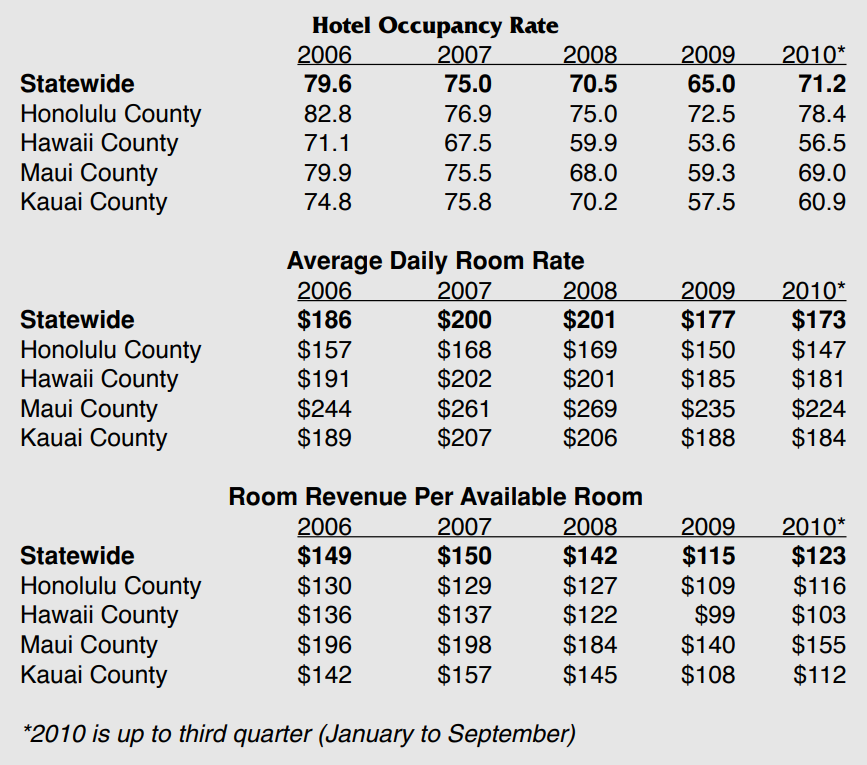

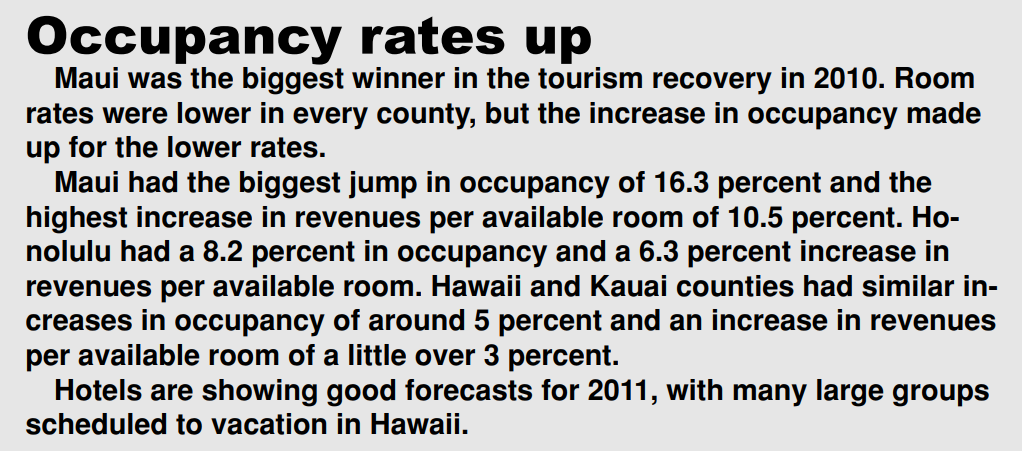

Data collected by the University of Hawaii Economic Research Organization (UHERO) shows a surprisingly strong recovery in tourism which is lifting other sectors of the Hawaii economy.

There were strong increases in arrivals and spending of both international and domestic visitors.

Oahu enjoyed the biggest increases, but Maui also saw significant growth in arrivals. This data does not include the 4th quarter of 2010.

State general revenue funds are expected to increase by 12 percent for fiscal year 2011-2012. Some of this is due to increased economic activity and some is due to higher tax rates to the transient accommodation tax and higher employer contributions to the unemployment fund.

While personal income increased by a slight 1.5 percent, it was offset by inflated costs of 2.5 percent, which meant real income based on buying power declined by 1 percent.

Real income is expected to climb back into positive growth of 2.3 percent and higher as the tourism sector continues to improve throughout 2011 and 2012.

The chart below shows UHERO forecasts to 2013. Data for the 4th quarter of 2010 and later years are estimated forecasts.

Workers, consumers win service charge lawsuits

In December 2010, State Circuit judge Gary Chang ordered the Kahala Hotel & Resort in Honolulu to pay over $800,000 in punitive damages to tipped employees and customers over violations of a Hawaii state law requiring disclosure if management takes any portion of the service charge intended for tipping employees.

The hotel had argued it did not break the law because its managerial staff were also employees. This argument was rejected by the jury. The jury found that the hotel failed to pay $269,114 in service fees to its employees in violation of the state law. The Hawaii law allows for triple damages which comes out to $80,342. The Kahala Hotel is appealing the judgement.

Similar lawsuits have been filed against the Hilton Hawaiian Village Beach Resort & Spa, HTH Corporation which owns the Pacific Beach Hotel and owned the Pagoda Hotel & Restaurant, the Grand Wailea Resort on Maui, the Four Seasons Resort, and the Fairmont Orchid on the Big Island.

Restaurants are also being sued. An employee of the clubhouse at the Kapolei Golf Course on Oahu has sued management for taking part of the 15 percent service charge of 1,600 to 2,200 banquets held at the golf course’s clubhouse from March 2000 to December 2009.

Earlier in July 2010, the Turtle Bay Resort settled before their case went to trial. The hotel agreed to pay $526,000 to 130 tipped employees who worked for the hotel from January 2005 to January 2009. The Resort will also pay all court and attorney fees of $150,000. The payment to employees was based on the number of hours the employees worked during this period. The former owners of the Maui Prince Hotel have also agreed to pay a cash settlement to their employees.

Perkin and Faria is the lawfirm handling these lawsuits. The firm expects other hotels and restaurants will be sued as more employees become aware of the lawsuits.

A Hawaii law passed in 2000 (HRS §481B-14] requires any hotel or restaurant that applies a service charge for the sale of food or beverage services to distribute the service charge directly to its employees as tip income or clearly disclose to the purchaser of the services that the service charge is being used to pay for costs or expenses other than wages and tips of employees.

The Hawaii law sought to protect consumers by preventing deceptive practices and unfair competition. It common for many restaurants to automatically add a service charge of 15-18 percent to a group of 6 or more people. Hotels also add a service charge to food and beverage functions. Customers assume that all of this service charge is given to employees as tips. If management keeps some of the service charge, then the Hawaii law requires the hotel to inform their customers.

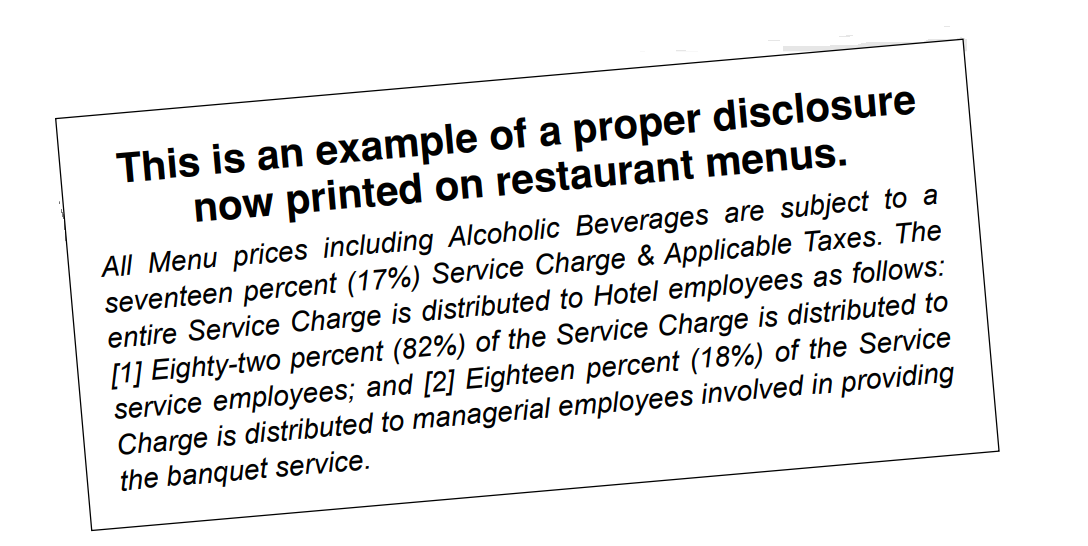

Hotels and restaurants can avoid getting into trouble by simply printing a notice on their menus that a portion of the service charge goes to management.