Government regulation and oversight of the banking and investment industry could have prevented the economic crisis. Instead, Bush and the Republicans dismantled any effective regulation of the financial industry. They continue to believe less government and less regulation is good.

Most unionized workers have pension plans that are insured and guaranteed by the federal government, through the Pension Benefit Guaranty Corporation (PBGC).

All defined benefit pension plans must pay for this insurance and must follow very strict rules and regulations set by the government. One rule requires pension plans to have enough cash and assets to cover 60 percent of the benefits earned by workers covered by the plan.

While the federal government has very strict regulations for pension funds, there were no rules or regulations on the mortgage-backed securities sold by banks and investment brokers which caused this worldwide economic crisis. In fact, Republican-backed legislation in 2001 actually forbid any government regulation of these securities.

The banks sold these securities and were not required to have the cash to back these securities. The ILWU staff pension plan has to guarantee 60 percent of our pension benefits. Lehman Brothers had enough cash to cover maybe 3 percent of their financial commitments and that’s why they had to seek bankruptcy protection. This is why governments around the world are forced to spend billions of dollars to bail out their banks.

Worldwide credit shortage

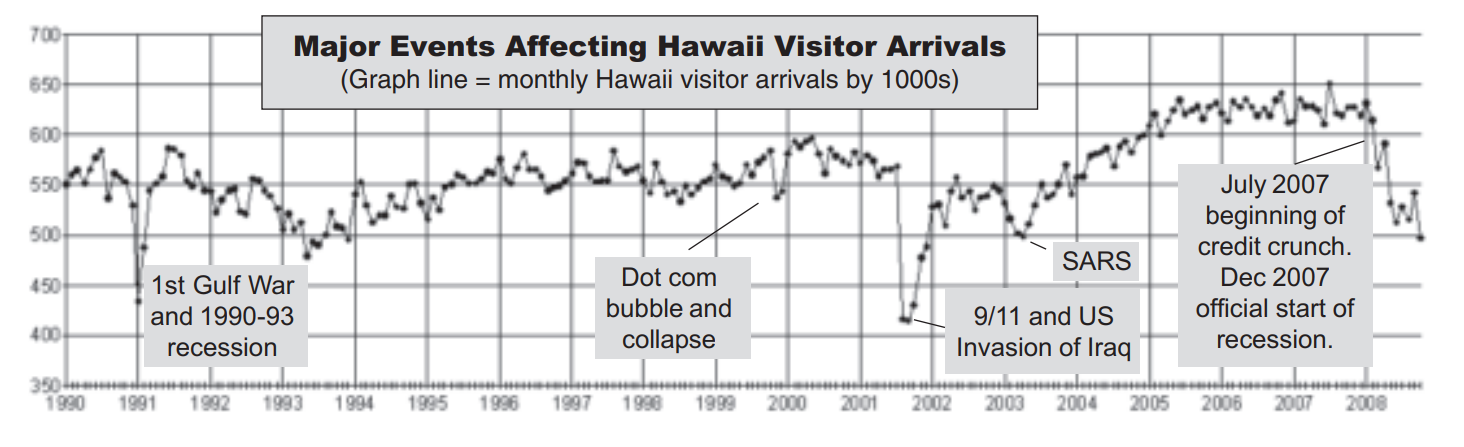

By the end of 2006, US investment banks had sold over $2 trillion of mortgage backed securities and Collateralized Debt Obligations or CDOs, which were bought by US and foreign banks, pension funds, investment funds, and individuals. These CDOs were supposed to be low risk, high quality investments which returned a very high rate of 10 and even 20 percent a year, which was two to four times more than normal investments.

In reality, CDOs contained mostly high risk assets such as sub-prime mortgages and were not worth what was paid for them, and were likely to lose value over time. Investors and banks around the world had paid far too much for CDOs which may only be worth half their face value or less.

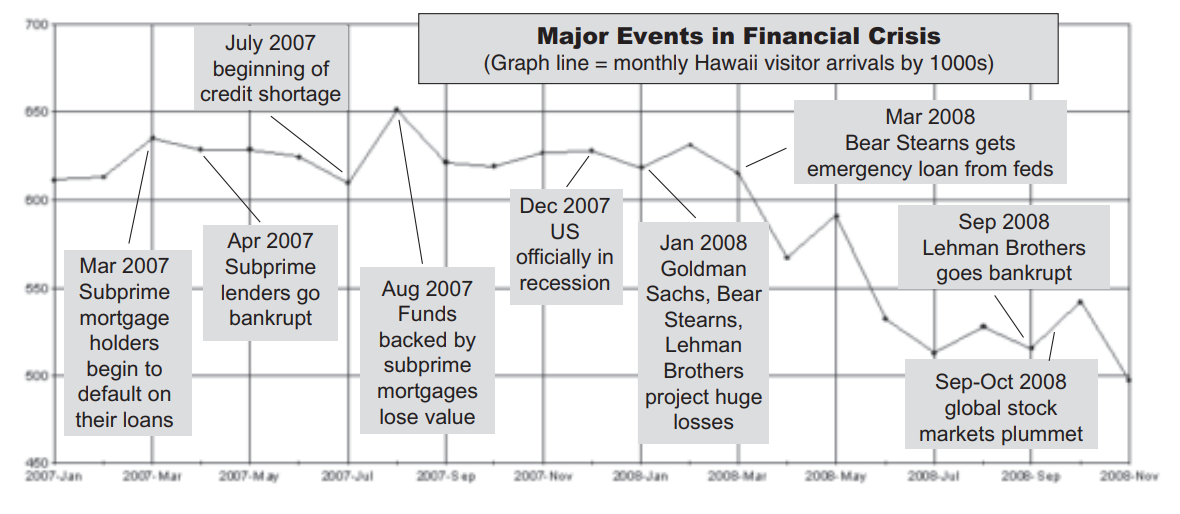

In 2005, thousands of adjustable rate mortgages kicked up monthly payments and sub-prime borrowers defaulted on their loans. Over 200 US mortgage companies declared bankruptcy, unable to repay their loans from bigger banks. The big banks themselves had raised money by selling CDOs and faced potential losses of billions of dollars and didn’t have enough cash to cover these losses. In 2007, Lehman Brothers was forced into bankruptcy when banks refused to loan them money to pay off their debts. Bear Stearns and French investment bank, BNP Paribas, froze several of their funds which contained CDOs.

Worldwide credit shortage

Banks began hoarding cash to cover potential losses and stopped lending money to each other, fearing they would not be repaid. This caused a shortage of credit that affected all areas of the economy and pushed the economy further into recession.

Businesses rely on short term loans and credit from banks for their normal day-to-day operations. Banks cut back on short-term credit and stopped making loans for construction projects and to consumers who wanted to buy cars and houses. This forced businesses to sell stock or layoff workers to raise cash for their operations. The large sell-off of stocks pushed stock prices down, leading to huge losses in the stock market.

Consumers stop buying

While the biggest losers were the investors and banks on Wall Street, the constant bad news eroded US consumer confidence. Consumers cut back on their Christmas spending and purchase of higher cost items such as automobiles and household appliances. Unusually bad weather also kept consumers at home and away from the shopping malls on important shopping days such as the day after Thanksgiving and the day after Christmas. The combination of devalued CDOs, stock market losses, and weak consumer spending played off each other causing a downward spiral of the US economy. As the US economy sank it began to drag the world economy down.

Sub-prime mortgages

Sound banking/lending practices in the past required homebuyers to pass strict standards to qualify for a loan or mortgage. Buyers had to put a down payment of 10 to 20 percent. They had to earn enough income to pay the monthly payments, along with any other loans and expenses such as car payments. They had to have a good credit history of paying their bills on time, and low or no balances on their credit cards. They had to have an assessment of the value of the house they were buying, and they had to carry insurance on the house. All of this guaranteed the bank would profit from making this loan. These were prime mortgages, good as cash in the bank, and were often sold and resold to other banks and investment companies at a profit.

In the 1990s, many of the laws regulating banks, securities, mortgages, and investments were changed to reduce government regulations which would supposedly be good for business and the economy. To further stimulate the economy after a mild recession, the Federal Reserve cut interest rates from 6.5 percent in 2000 to 1.75 percent in December 2001.

With plenty of money available at low interest rates, banks and mortgage companies began making home loans to millions of people who could never afford to qualify for a conventional mortgage. There were various gimmicks used to make the loans seem affordable, such as no down-payments, interest-only loans, and adjustable rate mortgages. The monthly payments would be affordable for a few years, then the monthly payments or interest rates would increase. These were called sub-prime mortgages.

The tremendous increase in housing sales led to huge jumps in home prices in states such as Nevada, California, and Florida. There were many stories of people buying property and selling them a few months later for huge profits. New housing developments would be sold out before homes were even built.

Investment banks and sub-prime borrowers were not thinking about the risk. They assumed the value of the houses would increase forever, and they could always sell the property for a big profit. To raise even more money and make more loans, banks packaged these sub-prime mortgages together with prime mortgages and sold them as mortgage-backed securities called Collateralized Debt Obligations (CDOs).

These CDOs were sold to investors, hedge funds and banks all over the world. Some of these mortgages were guaranteed by Fannie Mae and Freddie Mac and appeared to be safe investments. Fannie Mae is the Federal National Mortgage Association and Freddie Mac is the Federal Home Mortgage Corporation. These are privately owned mortgage companies, backed by the financial resources of the US government.

Around 2005, thousands of adjustable rate mortgages reset at higher rates and sub-prime borrowers were faced with huge increases in their

—continued on page 6