Forbes Magazine has compiled a list of the world’s billionaires for the last 25 years. Their list for 2011 contained 1,210 people from 55 countries. The United States had the largest number of billionaires with 413; followed by China with 115 (this does not include 36 billionaires from Hong Kong). Russia came in third place with 101 billionaires, followed by India with 55 and Germany with 52.

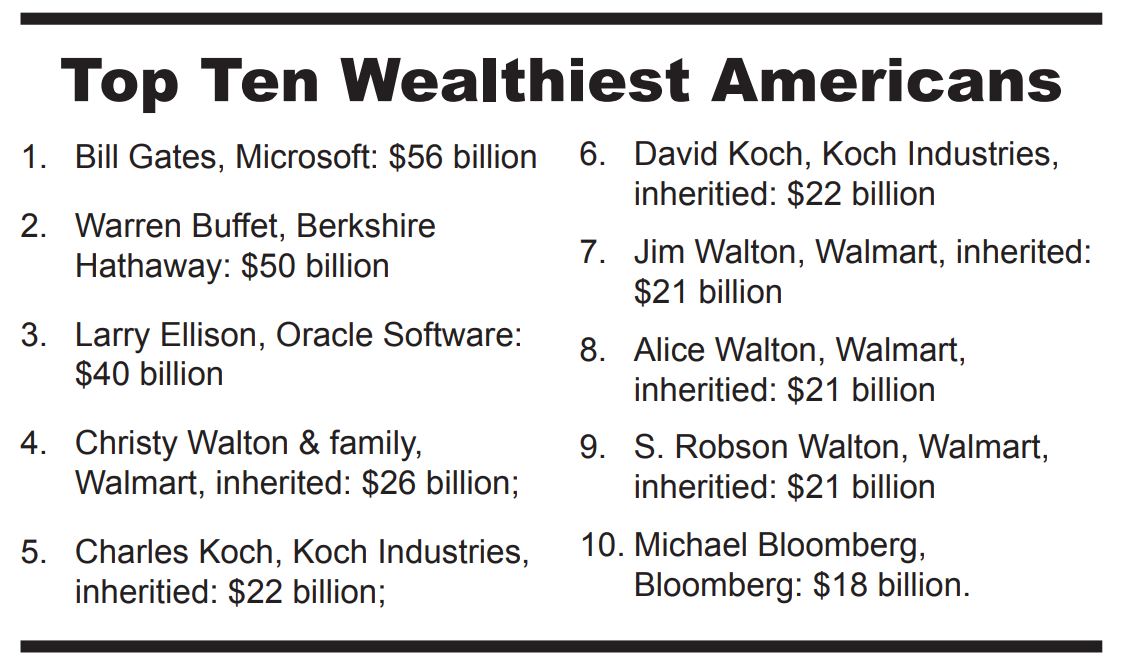

Carlos Slim Helu of Mexico was the world’s richest person with a net worth of $74 billion. Bill Gates from the United States was the second richest with a net worth of $56 billion and Warren Buffet was worth $50 billion. Bernard Arnault of France’s Louis Vitton was the fourth richest person with a net worth of $41 billion.

Four members of the Walton family in the United States, heirs of the Walmart empire, have a combined wealth of $90 billion. The two Koch brothers—Charles and David—inherited $44 billion and give a lot of money to Republicans and to promote conservative issues.

Inherited wealth

We took a closer look at the wealthiest 539 people who were worth over $2.2 billion. More than one-third or 193 people got a jump start by inheriting their wealth, businesses, and property. “Selfmade” billionaires numbered 346. Many “self-made” came from rich and powerful families and benefited from their connections. Bill Gates’ grandparents started Seattle’s National Bank and set him up with a million dollar trust account. Gates invests most of his money in Mexico, not Microsoft or U.S. companies.

In the United States, 69 percent of the billionaires were self-made and 31 percent inherited their wealth. In Mexico, South America, and India the figures are almost reversed where over 60 percent inherited their wealth and less than 40 percent are self-made. In Europe and Africa, about half are inherited and half are self-made

In Russia, China, and the United Kingdom most of the billionaires are self-made.

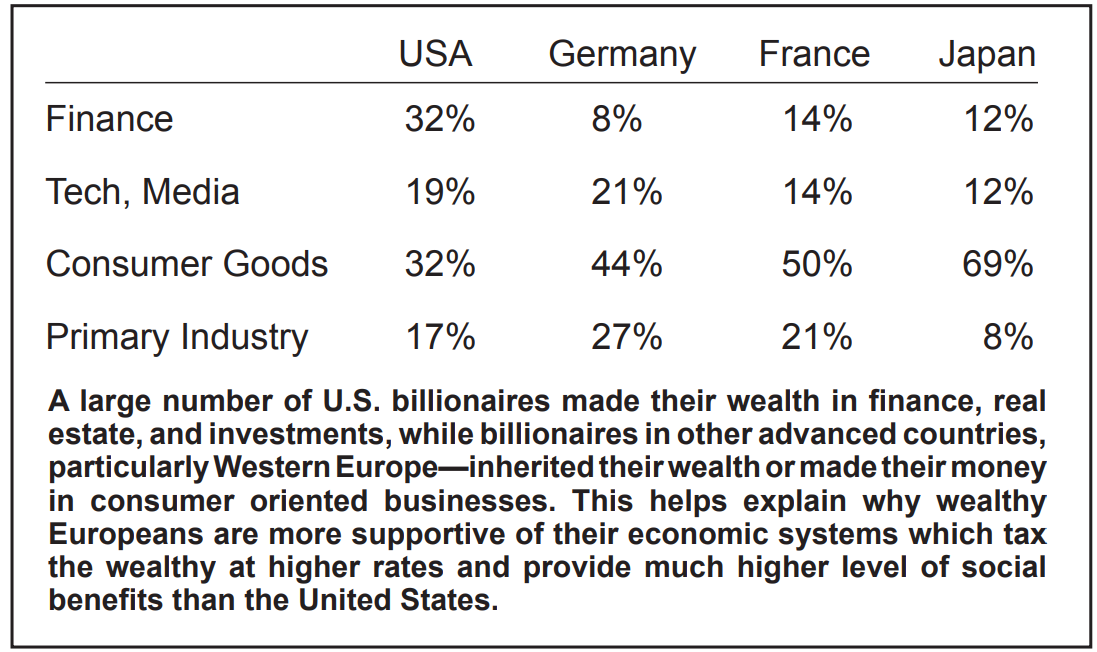

Different path to fortunes

In the United States, the largest group of self-made billionaires, 34 people, made their fortunes in finance and investments. The next largest group of 18 U.S. billionaires made their fortunes in software and the Internet such as Microsoft, Oracle, Google, Amazon, and Facebook. Americans dominated these two sectors with 65 and 64 percent of the world’s billionaires. Movies and entertainment created the fortunes for 14 Americans such as Oprah Winfrey and George Lucas.

In Russia, 36 of their 49 self-made billionaires made their money through control of raw materials and commodities. In China, real estate was the source of their self-made wealth. In Europe retailing was their path to wealth.

While the United States has the largest number of billionaires with 413, the United States also has a large population of 311 million people. This works out to one billionaire for every 754,814 people. The U.S. comes in at number 8 in terms of billionaires per person.

Tiny Monaco with 35,000 people has two billionaires—a per person ratio of one billionaire for every 17,500 people. Taiwan has 25 billionaires and a ratio of one billionaire to 156,008 people. Hong Kong has 36 billionaires and a ratio of one billionaire to 197,156 people.

The U.S. comes in at number 25 for average networth of $3.71 billion. Mexico had the highest average networth of $11.37 billion.

Billionaires call for higher taxes—on themselves

Warren Buffet revealed he paid less taxes than his secretary—17% of his income—in a story titled “Stop Coddling the Super-Rich” published in the New York Times on August 14, 2011.

“While the poor and middle class fight for us in Afghanistan, and while most Americans struggle to make ends meet, we mega-rich continue to get our extraordinary tax breaks.” Buffet explained that his income as an investment manager is classified as “carried interest” and taxed at only 15 percent. He paid a total income and payroll tax in 2010 of 17.4 percent, compared to the average 36 percent paid by the other 20 people in his office, including his secretary.

Buffet recalled that the taxes on the rich was much higher in the 1980s and 1990s, and the higher tax rates never stopped them from investing or creating jobs. “People invest to make money, and potential taxes have never scared them off.”

Buffet suggested that Congress continue the 2 percent reduction in payroll taxes and leave the tax rate unchanged for the 99 percent of taxpayers who earn less than $1 million. Buffet suggested Congress raise taxes on people earning more than $1 million, raise the taxes on capital gains and dividends, and raise taxes even more for the 8,274 individuals who make more than $10 million a year.

“My friends and I have been coddled long enough by a billionaire-friendly Congress,” Buffed concluded. “It’s time for our government to get serious about shared sacrifice.”

Warren Buffet is the second wealthiest person in the United States with a net worth of $50 billion. Buffet is the chairman and chief executive officer of Berkshire Hathaway. The wealthiest person in the United States is Bill Gates III who is worth $56 billion. Gates was the former chief executive officer and is currently the chair of the Microsoft Corporation.

French mega-rich agree to higher taxes

In France, a group of 16 mega-rich, including L’Oreal heiress Liliane Bettencourt, published an open letter on August 24 proposing they pay a higher tax as their contribution to the nation’s efforts to reduce its worsening deficit and debt situation.

The French tax increase proposed by President Nicolas Sarkozy’s government includes a three percent “exceptional contribution” on incomes over 500,000 Euros (about $673,000 U.S. dollars), closing tax loopholes, and eliminating deductions for the country’s largest companies. The tax on the rich would be automatically repealed when the deficit drops below 3 percent.

Many of the mega-rich who signed the open letter, such as Publicis Group’s Maurice Lévy, Dannone’s Franck Riboud, and Air-France-KLM chair Jean-Cyril Spinetta are recognized as management who put human concerns and employment priorities equal to or above strictly bottom line profits. In their letter, they explained that, “We are aware of having fully benefited from a French model and European environment to which we are committed and which we want to help preserve.”

The super rich in France recognize that their wealth, in part, comes from a social system where workplace democracy is the law and workers are paid higher wages and benefits.

The chart on page 5 shows France ranks number 11 in the world with an average compensation to workers of $41.94 an hour compared to the $32.26 average in the United States.